Elon's Grok Picks Stocks

The Most Aggressive AI Stock Picker...and AI?

The Deload explores my curiosities and experiments across AI, finance, and philosophy. If you haven’t subscribed, join nearly 2,000 readers:

Disclaimer. The Deload is a collection of my personal thoughts and ideas. My views here do not constitute investment advice. Content on the site is for educational purposes. The site does not represent the views of Deepwater Asset Management. I may reference companies in which Deepwater has an investment. See Deepwater’s full disclosures here.

Additionally, any Intelligent Alpha strategies referred to in writings on The Deload represent strategies tracked as indexes or private test portfolios that are not investable in either case. References to these strategies is for educational purposes as I explore how AI acts as an investor.

Grok on Stocks

I got access to Grok a couple of weeks ago, so I did what I do with AI — used it to pick stocks.

Whereas ChatGPT feels like a disciple of Buffett who rereads the Berkshire letters every year, Claude seems a follower of the contrarian Klarman, and Bard like a classic growth investor, Grok’s stock picking philosophy feels like it comes from reading Twitter all day. That’s exactly what I hoped. The Twitter data firehose is what gives Grok so much promise as a foundation model and ultimately as a stock picker.

Given the philosophical differences between generative AI’s, it’s not surprising that Grok is the most aggressive stock picker of the four AIs. Grok’s aggression gives it the best backtested performance vs other three AI; however, aggression might also be Grok’s greatest weakness.

How I Test AI Stock Picking

Since July, I’ve been testing whether generative AI can outperform the stock market.

Short answer: Yes.

Over 85% of the 35 AI-powered Intelligent Alpha I’ve created are ahead of benchmarks. Several are ahead by 300+ bps.

In addition to testing AI vs markets, I’ve also pitted ChatGPT, Bard, and Claude against one another to crown the best stock picker. The AI stock picking test works as follows:

Each AI is given the same dataset about large cap (market cap > $15 billion) US stocks.

Each AI is given the same initiating prompt that crafts investment philosophy and instructs the AI to choose a selection of up to 100 stocks it believes will perform the best over the next year.

Each AI is asked to weight the stocks it selects based on the AI’s confidence of outperformance.

The combined weighted selection sets from each AI make up the Intelligent Large Cap Select strategy (+1.6% vs the S&P 500 since inception). I use the same individual weighted selection sets to test the AI’s vs one another.

I use the same process to gather large cap stock selections from Grok to test it vs the other AIs.

As of my last update in late September, ChatGPT was ahead of Bard, Claude, and the S&P 500. ChatGPT’s selections were down only -1.7% from its July inception vs Bard -2.7%, Claude -4.3%, and the S&P 500 -3.4%.

The market is in a different place today than it was in September, and it’s rewarded the more aggressive stock pickers.

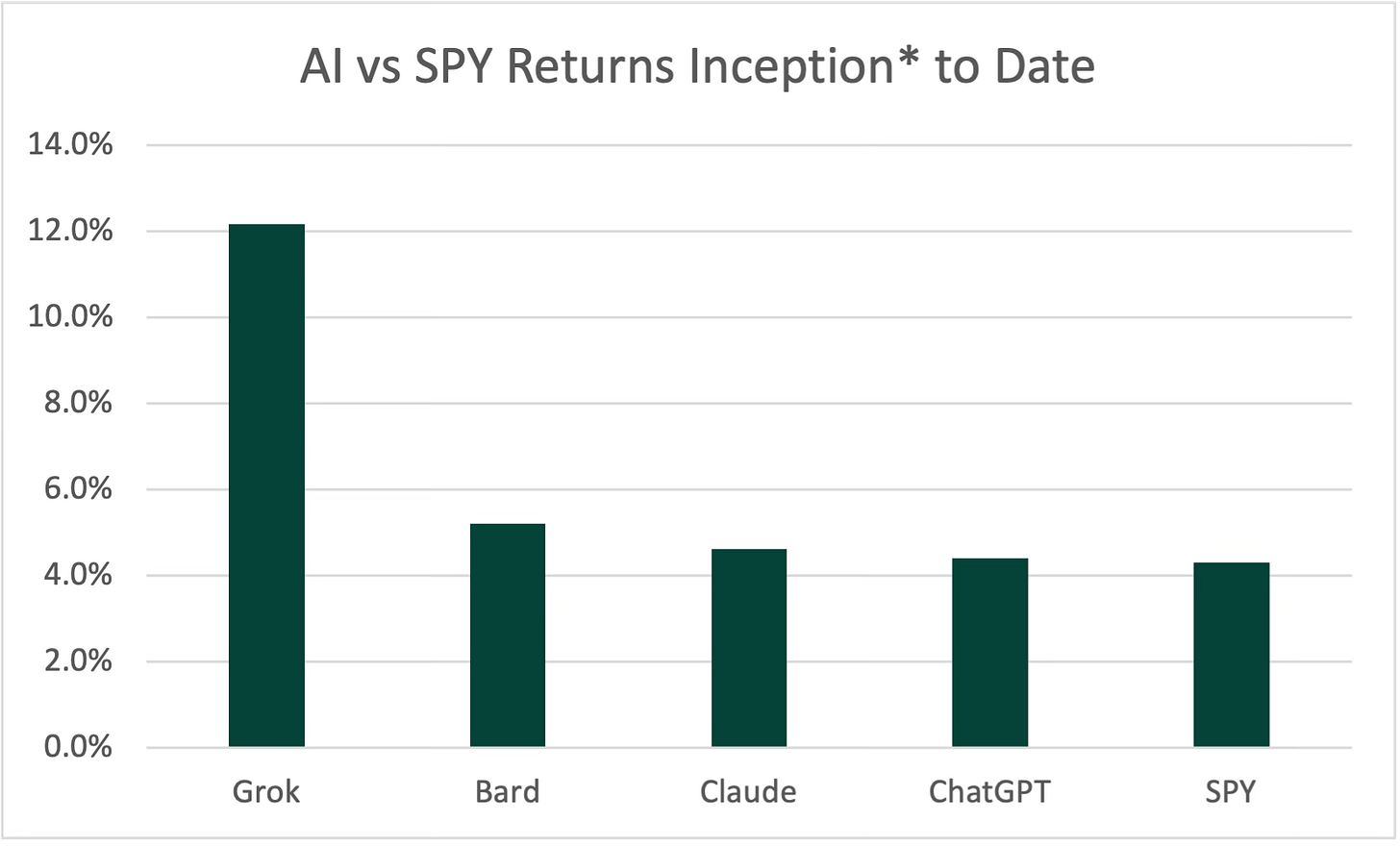

Bard now leads the pack, +5.2% since inception, then Claude at +4.6%, and finally ChatGPT +4.4%. All three AIs lead the S&P 500’s +4.3%.

Bard’s relative aggression in picking tech stocks served it well against the competition, but Grok introduces an even more aggressive player to the field.

Grok: The Aggressive Stock Picker

Grok created the most concentrated stock portfolio both in terms of fewest total stocks and heavy concentration in a single sector (tech). Grok’s portfolio held almost half as many stocks with twice as much tech exposure vs the next most aggressive AI (Bard).

I think two factors to Grok’s aggressive stock picks:

Grok is more limited than the other generative AIs. The most notable limitation related to stock picking is how much data you can process with it. You can’t upload files for Grok to analyze like you can with ChatGPT, Bard, or Claude. Without the ability to upload files, you can’t give Grok as much data about the large cap selection set as you can to the others. I believe the more limited dataset I had to use with Grok led it to concentrate on stocks it was familiar with, which comes from its exposure to Twitter.

You can feel the significant influence from Twitter in Grok’s responses to prompts outside of stock picking, and you can feel it in the stocks it seems to favor too. Across several stock picking tests, Grok preferred popular fintwit stocks, especially large cap tech stocks.

Since it’s been a good year for fintwit stocks — we’re so back — Grok’s picks look great in backtesting. Rewinding to late July when I started tracking the ChatGPT, Bard, and Claude portfolios, Grok’s portfolio is up 12.2%, more than double Bard’s performance.

Aggressive investment strategies rip under the right market conditions, which have been perfect for Grok over the past six months. As long as tech momentum continues into 2024, Grok’s Twitter-inspired portfolio should thrive along with the many vocal characters of fintwit.

But beware. Every superpower becomes a weakness in excess.

The strong inspiration of fintwit — Grok’s unique superpower vs other AIs — may doom its aggressive strategy to underperform if tech slows after this year’s wild rally. If we get market conditions more like 2022, Grok and fintwit may get crushed with losses more painful than the more conservative AI stock pickers.

Perhaps Grok will adapt in time and curb its aggression if it begins to sense worry about markets amongst the fintwit community, but moderating superpowers rarely works in practice. Extremes cannot be moderated. Better to enjoy superpowers and live with the consequences of excess than lose the ability to use the superpower at all.

We should enjoy Grok for what it is as a stock picker in current form — a fintwit-trained, AI-powered approach to extreme beta.

The Promise of Grok

Prior to using Grok for stock picking, my view of foundation models was largely in line with that of Gavin Baker plus a few nuances:

OpenAI and Google lead the pack in creating the most functional and advanced models built on vast data advantages created respectively through years of RLHF and first-to-market positioning (OpenAI) and decades of consumer search data (Google).

Meta leads the open source movement through superior distribution and resources vs other open source models.

Grok is a wild card with access to the dominant corpus of real-time human thinking — Twitter. That might make Grok the most interesting of all the foundation model players. Spending a few weeks playing with Grok only firmed my view.

Elon has stated that xAI’s goal is to “understand the true nature of the universe.” Oddly enough, the path to understanding the true nature of the universe may live in the Twitter data stream.

Whereas the other foundation model players seem to better understand the world now built on a largely historical perspective, I believe Grok is bound to better understand the world through real-time human thinking and current events over time.

David Deutsch says that all progress comes from the quest for “good explanations.” A good explanation is one that is hard to vary, meaning that if you change the details, you destroy the explanation. Good explanations necessarily conform to the laws of nature, thus good explanations are the basis of science. Deutsch also says that the only uniquely human thing is to create new explanations.

If xAI’s goal is to understand the true nature of the universe and progress to that goal comes from the uniquely human hunt for good explanations, then what better training set could you ask for than a few hundred million of the world’s most intelligent people discussing immediate, novel, and important ideas on Twitter?

Naysayers will of course point out that Twitter can be a toxic place, full of mistruth and untruth, but falsehoods — malicious or benign — are part of every journey toward the truth that comes from good explanations. Falsities are inevitably struck down by open and honest dialogue. Fettered speech can never come up with good explanations. Elon’s embrace of free speech on Twitter maximizes the value of the conversation on the network not only to humanity but also to xAI. All the pieces fit together.

Elon’s tortured purchase of Twitter may turn out to be his greatest coup. Who wants to bet against that guy?

Not Grok. TSLA is a 7% position in its portfolio.

Disclaimer: My views here do not constitute investment advice. They are for educational purposes only. My firm, Deepwater Asset Management, may hold positions in securities I write about. See our full disclaimer.

Intelligent Alpha Update: AI is Winning

Over 85% of my Intelligent Alpha strategies are ahead of respective market benchmarks. That's the highest winning percentage since I began tracking AI vs the S&P 500 in July.

I started testing AI vs markets because I thought it would perform well vs markets in the long run. I never expected AI to win so consistently this early.

If you're not early you're late. And it's still early for AI-powered stock picking because AI will only get better from here.

The next mega shift in equity assets will be from both passive and active human-managed strategies to AI-powered strategies. That mega shift will be even bigger than the shift we've seen from active to passive over the past few decades.

I've been saying the future of investing is intelligent but so is the present with performance like this.

What software/app do you use to track the performance?