My Obsession for Investing with Gen AI

3 Lessons from Using Generative AI to Build Effective Investment Strategies

The Deload explores my curiosities and experiments across AI, finance, and philosophy. If you haven’t subscribed, join over 1,500 readers:

Disclaimer. The Deload is a collection of my personal thoughts and ideas. My views here do not constitute investment advice. Content on the site is for educational purposes. The site does not represent the views of Deepwater Asset Management. I may reference companies in which Deepwater has an investment. See Deepwater’s full disclosures here.

Additionally, any Intelligent Indices strategies referred to in writings on The Deload represent strategies tracked as indexes that are not investable. References to these strategies is for educational purposes as I explore how AI acts as an investor.

Curiosity —> Obsession

People are attracted to greatness because it’s the ultimate inspiration. Everyone wants to be great at something. When we witness greatness, we can’t help but admire the effort and sacrifice that went into it.

The last few minutes of Kobe Bryant’s final game is a tribute to greatness. Kobe scores 15 points in three minutes on the way to 60 total to win the game and end his career. The crowd filled with fellow greats Jay-Z, Shaq, Snoop Dogg, and Jack Nicholson can’t believe it.

Kobe wasn’t great merely because of talent or genius. He was great because he was obsessed with basketball. He was legendary for 3 AM workouts and endless film study. Kobe’s obsession propelled him to be a great among greats. He was a top five player during his era, arguably top five in history.

Obsession is the only way to be top five at something. Not only do you work harder, but you gain unique insights about your passion that casual observers can’t. Hard work and unique insights work in a virtuous cycle that fuels success. Obsession must be the aspiration for all who want to achieve greatness.

There are two paths to obsession: Lucky discovery or persistent curiosity.

Kobe was lucky to intersect with basketball at an early age, have that interest grow into obsession, and spend his life pursuing it. Many who achieve greatness at an early age had the luck of finding early obsession.

Most people don’t stumble on an early obsession. The rest of us have to find our obsession through persistent curiosity.

Last week I wrote about curiosity:

Experimentation is the true form of curiosity because experiments are experience, and the whole point of curiosity is to gain usable knowledge.

You have to experiment persistently until you find something that forms an obsession. Obsession demands unyielding effort. Unyielding effort results in greatness.

For the past few months, I’ve been persistently experimenting with using generative AI to create investment strategies. It’s become an obsession. I now have 23 Intelligent Indices live with my friends at Thematic, and I’m testing some other alternative strategies like long/short as well.

My obsessive experimentation with generative AI for investing strategies has convinced me of two things:

AI understands investing now, and it will only get better.

AI will reshape how investors think about both passive and active investing, and professional investors will face the Innovator’s Dilemma.

Intelligent portfolios will challenge the market over time.

AI Understands Investing

Using AI trade stocks isn’t a new idea, but it is new to use it invest in stocks.

Jim Simons and Renaissance Technologies revolutionized the idea of using data to power quantitative trading strategies. He was early to embrace AI, and he made billions of dollars using machine intelligence to beat markets.

But quant strategies don’t fall in the category of investing, at least according to Warren Buffett.

One of the most important Buffett quotes investors must understand is the distinction between investing and speculating:

“When I buy a stock, I don't care if they close the stock market tomorrow for a couple of years because I'm looking to the business — Coca-Cola, or whatever it may be — to produce returns for me in the future from the business.

Now, if I care if whether the stock market is open tomorrow, then to some extent I'm speculating because I'm thinking about whether the price is going to go up tomorrow or not. I don't know whether the price is going to go up.

Speculation, I would define as much more focused on the price action of the stock.

Because you are not really — you are counting on — for whatever factors, because you think quarterly earnings are going to be up or it's going to split, or whatever it may be, or increase the dividend — but you are not looking to the asset itself."

Quant shops leverage machine intelligence to speculate on stocks based on some edge created by data and speed. Statistically, they’re making a portfolio of bets that should pay off in the long run, but per Buffett’s definition they’re still speculating because they don’t care about the fundamentals of the business.

To invest in the Buffett way, AI must understand why Coca-Cola might generate great returns as a business, not just understand that there are attractive signals to buy KO and sell it a short time later. The skeptical fundamental investor might convince himself that AI will never process the qualitative factors that make great long-term investments — brand, trends, management teams, product quality, etc.

But I believe AI is now capable of developing qualitative understandings of the world in a way it couldn’t before.

Part of the skepticism about AI for many tasks is that it doesn’t “understand” the world. AI is a prediction engine, not an understanding engine. LLM’s are built on the concept of predicting the next thing to output something that makes sense, not to understand whether it’s giving good advice about investing or anything else.

The use of the word “understand” is the issue. Does AI understand things as a human does? It doesn’t appear to, but I think that’s an irrelevant comparison. Ilya Sutskever, Chief Science Officer at OpenAI, has spoken about the argument that AI doesn’t understand things. Paraphrasing his view — to predict you must at some level understand. Otherwise the predictions wouldn’t be useful.

My experience using generative AI to create investment strategies tells me that AI understands something of the task I give it, and it starts with the quality of the prompt.

My base process looks like this to use generative AI for creating investment strategies:

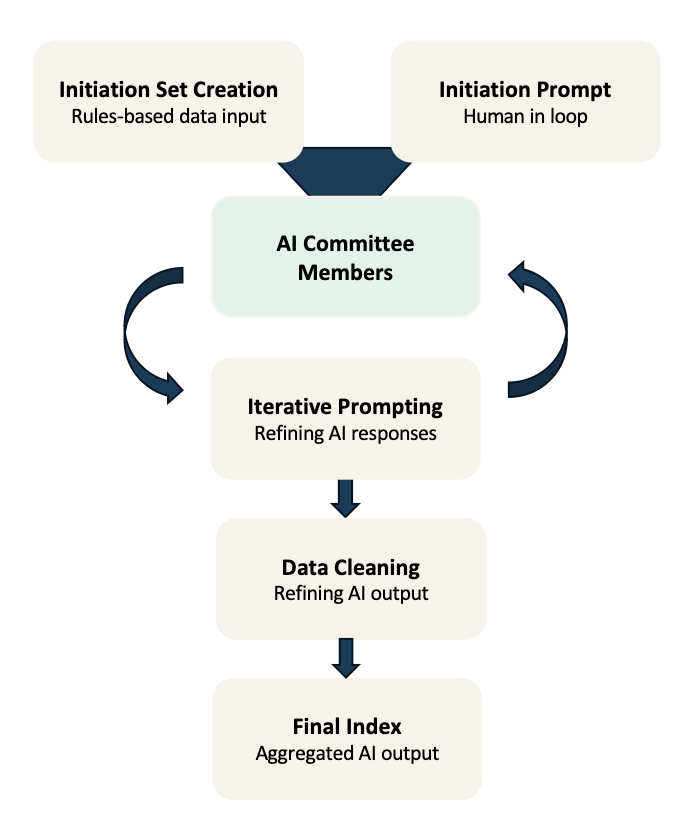

I prompt a group of different generative AI tools, which I call my committee, with data and detailed instruction. Sometimes the instruction set is more than a page long. After the task is set, there’s often some iteration on the prompting to make sure the task is understood. The AI committee members output data, I clean the data, and that results in an index or active strategy.

Through this process, AI committee members have demonstrated understanding of the task in two major ways: creativity and consensus.

Marc Andreessen once said that hallucination in AI is another word for creativity. I’ve had several instances where AI committee members suggested long and short ideas that weren’t in datasets that I provided to the AIs. These may seem like hallucinations, but they were relevant to the broader context of the strategies I was trying to build at the time. The AI understood I was looking for tech stocks or energy stocks or European stocks and hallucinated relevant ideas. That is creative, and it’s useful.

Across the committee of generative AI tools I use, I often see some consensus around favored ideas relative to a given instruction set. The AI outputs kind of look like what you’d expect from a cross section of investors focused on the same sector or factor or region where there are some consensus longs and then dispersion amongst other ideas.

AI understands what I’m asking well enough to create useful output given the early returns (see the end of this post), and it will only get better. As Sutskever from OpenAI reminds us:

Always keep in mind not just where things are now, but where things will be in 2-4 years and try to plan for that…how will it affect some of the basic assumptions about what the product is trying to do.

In 2-4 years, AI will understand even more about the world, and it will force investment managers to adapt or die.

The Passive Investor’s Dilemma

Steve Jobs loved the Innovator’s Dilemma which suggests that successful companies are incentivized to not disrupt their existing strength with new innovation. Why would anyone want to disrupt a beautifully profitable market?

The resistance to disrupt oneself is why disruptive companies exist. It’s why the venture world exists. That’s fundamentally what we’re looking for: Companies that can disrupt massive incumbents to capture huge customer share by delivering 10x better products.

The story of the last two decades in the investment world has been the disruptive shift from active to passive. The emergence of the ETF wrapper — a technological innovation — fueled that shift. The hosts of Bloomberg’s excellent Trillion’s podcast have suggested that the shift from active to passive was just as much about the shift from expensive investment products to cheap ones.

Over the next two decades, the story will shift from money flowing to intelligent strategies instead of passive ones. AI will beat unintelligent passive benchmarks that intentionally don’t understand fundamental or qualitative elements of the businesses they represent. And AI will beat those benchmarks without the traditionally high costs from active strategies.

Investment firms built on offering low cost passive strategies will shift from disruptor to disruptee unless they figure out how to incorporate AI into their product offerings.

I believe there will be $10 billion+ AUM ETFs powered by AI investment strategies over the next decade. Maybe many of them.

AI Must Generate Returns, And It Will

Markets are the ultimate test of what works or doesn't work. AI-powered investment strategies will only win if they outperform legacy benchmarks in the long run. Track records are built over years, not months, but early results are encouraging. The Intelligent Select Equal, Intelligent Tech Select, and Intelligent Blue Chip are all outperforming their legacy benchmarks since inception in July, and the Intelligent Select is just slightly behind the S&P 500.

Comparing the fundamental metrics between the Intelligent Indices and legacy benchmarks demonstrates the investment approach of the AI committee. The AI committee optimized for growthier companies with healthy earnings rather than absolutely cheap ones. Those are the kinds of companies you’d be comfortable owning if the market closed for the next decade as in Buffett’s quote. You might not want to own the absolute cheapest companies if you couldn’t sell. You’d want the best, and the best aren’t often the cheapest. If superior returns come from owning superior companies, then the Intelligent Indices should win over time.

The early results stand tall today, and they’ll only get better as AI gets more powerful.

Technological paradigm shifts revolutionize the world at inception, but then they look absurd in the rear view mirror with years of evolution after. The early Internet looks archaic vs our current version with 30 years of maturity. The original iPhone is a paperweight compared to the coming iPhone 15. Even early Facebook was just a digital yearbook page. Now look at social media.

AI will enjoy the same evolution. We will look back in five, ten, fifteen years and laugh at the silly hallucinations and annoying misunderstandings of our current generative toys of today vs the power tools we’ll have access to in the future.

The S&P 500 will be the next thing that looks archaic.

Follow the progress of Intelligent Indices on Thematic.

Sounds like an intelligent discussion