Can ChatGPT Beat the S&P 500?

We're going to find out with Intelligent Indices

For the past several weeks, we’ve explored how AI will change our lives and create investment opportunities, but I haven’t touched a lot on how AI will change investing. Today, we talk about the future of stock indices.

The Deload explores my curiosities and experiments across AI, finance, and philosophy. If you haven’t subscribed, join over 1,500 readers:

Disclaimer. The Deload is a collection of my personal thoughts and ideas. My views here do not constitute investment advice. Content on the site is for educational purposes. The site does not represent the views of Deepwater Asset Management. I may reference companies in which Deepwater has an investment. See Deepwater’s full disclosures here.

Additionally, any Intelligent Indices strategies referred to in writings on The Deload represent strategies tracked as indexes that are not investable. References to these strategies is for educational purposes as I explore how AI acts as an investor.

The Next Great Stock Index

Technology paradigm shifts disrupt existing order. That’s the point of a paradigm shift — a change so profound it both enables and forces the world to do things differently. We all see the AI shift coming to disrupt everything from search to communication to entertainment and beyond, but sometimes it’s the less obvious areas of disruption that can be the most exciting. One such case for AI is the stock index industry.

The next major stock index will be managed by AI.

Thousands of stock indices exist, but none rival the big four: the Dow Jones Industrial Average, the S&P 500, the Nasdaq, and the Russell 2000. The oldest of those indices, the Dow Jones, started in 1885. The Russell 2000 started almost 100 years later. And in the last 40 years, no new indices have emerged to challenge for a seat at the table of definitive market measures.

AI has to change that.

The point of a benchmark is to provide a fair comparison for alternative strategies, be they active or passive. The S&P 500 is the most commonly used measure of the market for many active managers, but as AI plays a bigger role in stock selection, a “passive” benchmark managed by a human committee seems less appropriate. A true benchmark for intelligent strategies should be built on intelligence itself.

We need Intelligent Indices to provide intelligent benchmarks not only for AI-driven investment strategies but even to challenge the S&P 500 itself as the dominant benchmark for all strategies.

Intelligent Indices

The difference between passive and active investment strategies isn’t binary, it exists across a spectrum.

Stock indices come in two main flavors. The first flavor index selects stocks entirely within the constraints of simple rules, like the Nasdaq 100 which is the 100 largest non-financial stocks listed on the Nasdaq. The second flavor of index relies on a committee of humans to select stocks within a set of rules, like the Dow Jones and S&P 500. Really, the S&P 500 is an active fund with very infrequent changes and rebalancing. I’ve previously written about this:

The S&P is actively managed by a committee that makes 500 stock selections according to certain rules, not purely passive guidelines. As a former committee member states, “There are no rigid or absolute rules for the S&P 500; the Index Committee has some discretion in selecting stocks or responding to market events.”

The same committee selection process is true of the Dow Jones Industrial Average (DJIA) too. From the selection process of the DJIA: “While stock selection is not governed by quantitative rules, a stock typically is added only if the company has an excellent reputation, demonstrates sustained growth and is of interest to a large number of investors.”

Intelligent Indices follow the second flavor of stock index as they only make changes on a quarterly basis, but they replace the human committee with AI. As a result, Intelligent Indices should be slightly more active than the S&P 500 but not as active as a typical mutual fund.

I’ve created three Intelligent Indices with Thematic to test against our current major benchmarks:

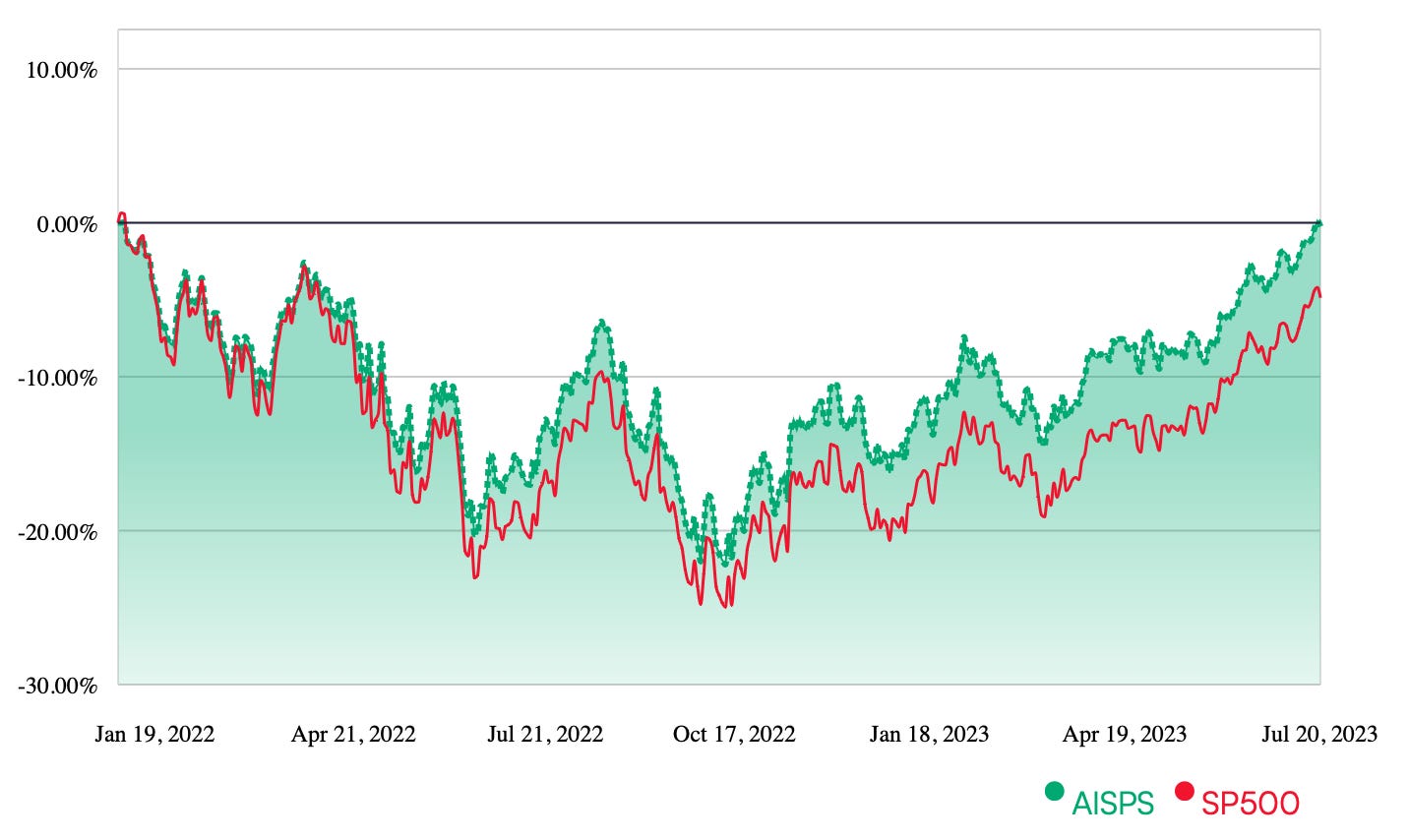

The Intelligent SP Select (AISPS) is a custom weighted selection of stocks AI expects to outperform relative to the rest of the S&P 500 index.

The Intelligent SP Equal (AISP) is equal weighted selection of a limited set of stocks AI expects to outperform relative to the S&P 500 Equal Weight index. Each AI used creates an equal-weighted selection set that is merged such that a stock may have a maximum of 3x the base weight where all three AIs used select a the same stock for the portfolio.

The Intelligent NQ (AIQQQ) is a custom weighted selection of stocks the AI expects to outperform relative to the Nasdaq 100 index.

To create the indices, I engineered prompts including historical data and forward estimates to ask OpenAI’s ChatGPT, Google’s Bard, and Inflection’s Pi to perform an analysis on the stocks in the reflective indices. Here’s how it works:

Each AI creates a selection set of stocks based on the same prompt and data.

I merge those selection sets into a single selection set that populates the index.

All three indices are re-prompted on a quarterly basis to rebalance the portfolios.

You can read a longer methodology for each index on the Thematic pages linked above.

In simple back tests to 2022, all three funds have outperformed their passive benchmarks, even with the recent run in both the S&P 500 and Nasdaq 100 driven by megacap tech. But backtests don’t prove anything. Whether these funds outperform their respective benchmarks going forward is the true test.

You can follow the progress on the Intelligent Indices page here on The Deload. I’ll also provide updates on the Intelligent Indices LinkedIn page.

AI Consensus and Dissent

Markets are built on consensus and profit is made on accurate dissent.

There was plenty of consensus and dissent in the stocks chosen by AI.

The AIs were less favorable than the big indices on AAPL, MSFT, and NVDA and somewhat mixed on AMZN and GOOG. The AIs favored tech names like CSCO, AVGO, INTC, and TXN as well as consumer and healthcare names like COST, HD, PG, and UNH.

Generally, the AIs seem to prefer lower multiple stocks and expect some sort of mean reversion away from big tech. Perhaps not a bad bet.

As I was working with the AIs to get their stock picks, part of me questioned how much the AI really understood the job of picking stocks. We know these systems work to predict what words make sense in the context of the prompt and on-going response which doesn’t create the sense of deep understanding of a task.

So I asked ChatGPT why it weighted AAPL below the benchmark. ChatGPT responded:

I weighted AAPL below the index for a few key reasons:

AAPL's revenue growth is expected to slow to 6.6% in 2023 compared to 33.7% growth in 2021, indicating potential growth headwinds.

While still strong, AAPL's ROCE has declined from 56.3% in 2021 to an estimated 62.4% in 2022 as growth moderates.

At a forward P/E of 29.4x, AAPL trades at a significant premium to market multiples, limiting further upside.

AAPL faces challenging comps from strong pandemic-driven iPhone sales over the past 2 years that will be difficult to beat.

Supply chain issues and China production shutdowns could constrain iPhone supply and sales in coming quarters.

AAPL's services segment growth is decelerating, reducing an important high-margin growth driver.

While AAPL remains a highly profitable company, its slowing growth, premium valuation, and near-term headwinds led me to underweight the stock in favor of stocks with stronger growth outlooks and upside potential over the next year. However, over a longer-term time horizon, AAPL would likely warrant consideration based on the strength of its ecosystem.

We can debate what it means for an AI to “understand” something, but AI certainly knows how to respond with a list of what it should be looking for in making intelligent stock picks.

One fun bonus learning: AI hallucinates stock picks too. Claude picked LULU to be in the Intelligent SP portfolios even though it wasn’t in the selection set suggested to it. A solid pick though (we own LULU at Deepwater).

Another Trillion Dollar AI Market

The story of asset management for the past two decades has been the shift from active to passive. Per Morningstar, 45% of US assets are passively managed as of 2022 vs 24% in 2013. Active is 55% down from 76% over the same period.

But the passive trend engenders some valid criticism. Passive investing does not consider fundamental prospects of a company or even price. When you buy an index fund, you’re not considering the price of any of the assets in the fund that tracks the index because the index is designed not to. Like many Internet companies at scale, passive investing creates a winner take most outcome for the largest equities. Most major indices are market cap weighted, which means the companies with the largest market caps accrue the largest dollar share of passive flows.

Intelligent Indices fixes these passive issues by marrying passive-style infrequent portfolio changes via a quarterly rebalance with a respect for fundamentals and valuation given ChatGPT’s analysis of AAPL. Time will tell us if our Intelligent Indices can outperform the S&P 500, but proper prompting and structure, they should have a good chance.

Over $1 trillion is benchmarked to S&P 500 index funds in the US alone. If AI can consistently challenge the S&P 500, in the next decade or two we’ll be talking about a trillion dollars benchmarked to Intelligent Indices too.

Hi Doug, hope this finds you well. I am a big fan of your analysis and what you are doing with Gene since founding what is now known as Deepwater AM. I wanted to double check with you the $1t reference to the S&P 500 as this number appears to be far larger according to S&P as you can read here https://www.spglobal.com/spdji/en/indices/equity/sp-500/#overview. BTW, I completely agree with your hypothesis about how Generative AI will impact (I say disrupt) the indexing industry, and I also reckon the asset management industry more broadly. The manufacturing of investment strategies have been historically controlled by asset management companies and this - I believe - will no longer hold true in its entirety when crowd-sourced marketplaces flourish, and this is the case with CrunchDAO (https://www.crunchdao.com) which I am advising to be transparent. Thanks for your everything you do, it has been particularly helpful and welcoming! Rafael

Thanks Doug. Would you consider continuing the research on the disruption around indexing? I see the traditional players (i.e.: MSCI, S&P, etc) with tech debt that makes them slow to market and lethargic when attempting to innovate or lack thereof; nonetheless, their multiples continue to be rich such as those in the capital markets focused information providers category with 35.2x PE multiples. Best and feel free to reach out at rfebrescordero@waldenpondventures.com. Rafael