Intelligent Indices

Investing is about two O’s: optimism and opportunity cost.

Every investment starts with a spark of optimism about future return. If we’re pessimistic about some opportunity, or maybe even the world, then we shouldn’t invest. Put cash under the mattress, buy some T-bills, and hope the world doesn’t end. Or maybe hope it does.

With optimism in place, we can consider opportunity cost. When we allocate capital to some asset, we don’t allocate that capital to the plethora of other assets available to us. Market benchmarks establish the opportunity cost of making a specific investment rather than buying a basket of similar exposure.

In a sense, market benchmarks represent the hurdle rate for optimism.

If an investment can’t beat a related market rate of return, it’s not worth making. You’re better off channeling your optimism into a bet on the benchmark. Owning the benchmark guarantees you don’t lose to the market if you’re not sure you can outperform it.

Benchmarks for Where the World is Going

Stock indices were invented by journalists to report on the performance and health of financial markets — a benchmark to describe investor optimism.

The Dow Jones Railroad Average was the first stock index. It was created in 1884 by Charles Dow who published the Customer’s Afternoon Letter (now the Wall Street Journal). Dow started the more famous Dow Jones Industrial Average in 1896 to track the broader booming American industrial sector. Similarly, Poor’s Publishing established a 90-stock index in 1926 that later expanded to 500 stocks in 1957 — the S&P 500.

There are now more indices than stocks, giving us an array of ways to benchmark individual investments.

Why do we need so many indices? More specific indices give managers better tools to think about relative hurdles for investments they consider. If a manager doesn’t think a prospective investment can outperform a relevant targeted index, he shouldn’t make it because that capital would be better off in the index.

For a benchmark to be useful, it must be representative of the investment under consideration. It wouldn't make sense to benchmark an investment in AAPL to commercial REITs. Apple is a megacap tech stock with a persistent moat, not a real estate investment. While one might be choosing between AAPL and commercial REITs, a sensible benchmark for AAPL is a basket of the other biggest companies in the world — the S&P 500 for example.

As AI continues to emerge as the defining technological breakthrough of the next decade, it similarly makes little sense to compare investment strategies driven by AI to a passive benchmark, nor does it make sense to compare an investment in a fast growing AI company to a general set of large cap stocks. The Nasdaq 100 is half megacap tech stocks, a quarter non-AI businesses like Pepsi and Costco, and a quarter other tech.

The Deload is tracks a series of AI-focused and AI-powered indices to serve as definitive benchmarks for AI investments and strategies. These are the Intelligent Indices.

The Intelligent SP Select Index (AISPS)

The Intelligent SP Select index represents a set of large cap stocks that AI expects to beat the S&P 500.

For selection, ChatGPT, Bard, and PI each analyze a set of large cap stocks inspired by the S&P 500. Each AI allocates a 33.3% weighting scheme to up to 100 stocks it expects to outperform relative to the rest of the set. Each stock selected by the AIs is added to a selection set for the index. The weights for stocks selected multiple times are added together. The total selection set results in a 100% weighted allocation.

The index is reassessed and rebalanced by the AIs on a quarterly basis.

Live tracking of the index is available on Thematic here.

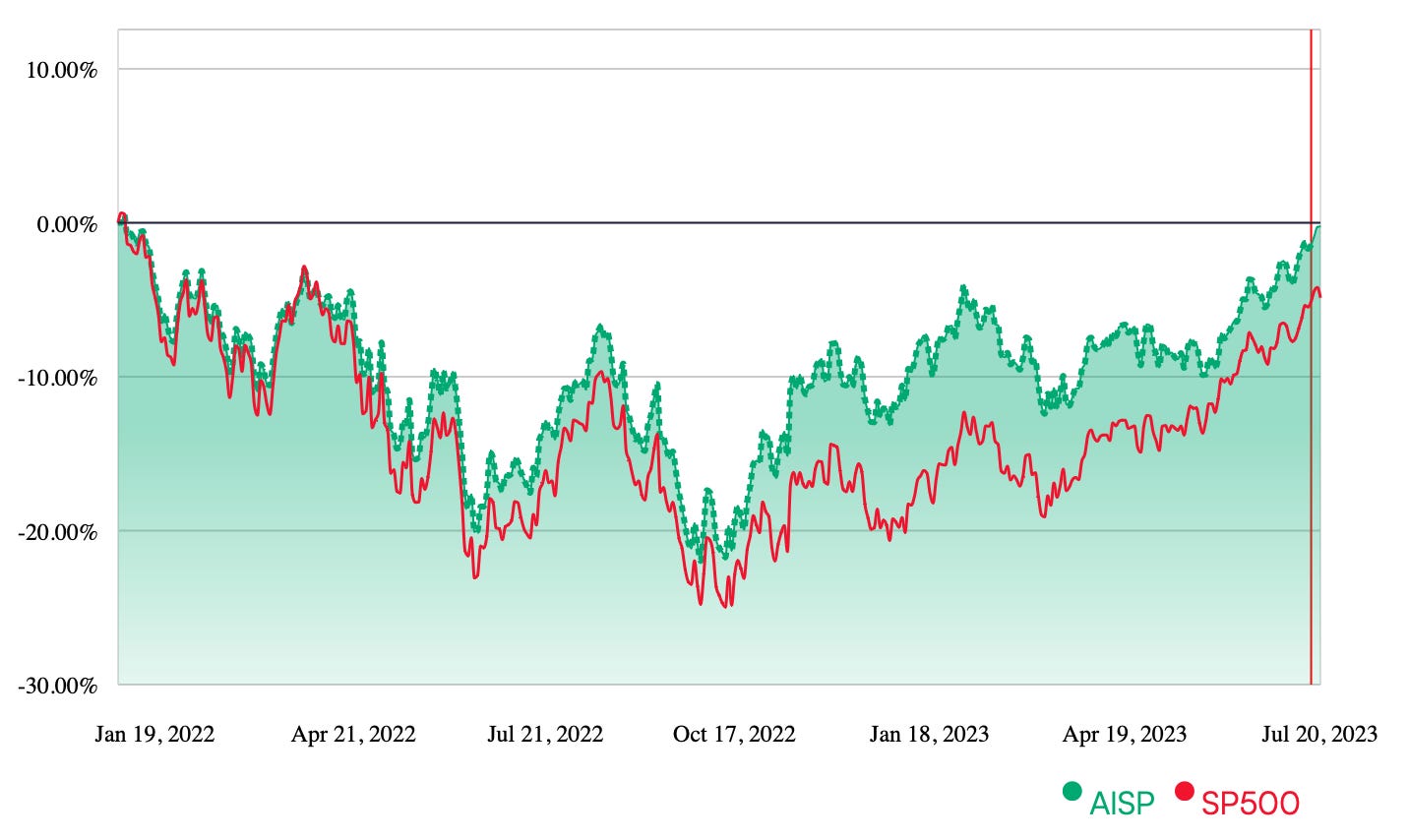

The Intelligent SP Equal Index (AISP)

The Intelligent SP Equal index represents a set of large cap stocks that AI expects to beat the S&P 500.

For selection, ChatGPT, Bard, and PI each analyze a set of large cap stocks inspired by the S&P 500. Each AI selects up to 100 stocks it expects to outperform relative to the rest of the set. The total number of stocks selected by the three AIs established a base weight (1/number of stocks selected). Every stock selected by the AIs is added to a selection set for the index. Stocks selected multiple times are attributed additional base weight, e.g. a stock selected by all three AIs would be weighted 3x base vs a stock only selected once at 1x base.

The index is reassessed and rebalanced by the AIs on a quarterly basis.

Live tracking of the index is available on Thematic here.

The Intelligent Q 100 Index (AIQQQ)

The Intelligent Q 100 index represents a set of large cap stocks that AI expects to beat the Nasdaq 100.

For selection, ChatGPT, Bard, and PI each analyze a set of large cap stocks inspired by the Nasdaq 100. Each AI allocates a 33.3% weighting scheme to the entire list of 100 stocks based on which stocks it expects to outperform. Every stock selected by the AIs is added to a selection set for the index with weights added together. The total selection set results in a 100% weighted allocation.

The index is reassessed and rebalanced by the AIs on a quarterly basis.

Live tracking of the index is available on Thematic here.

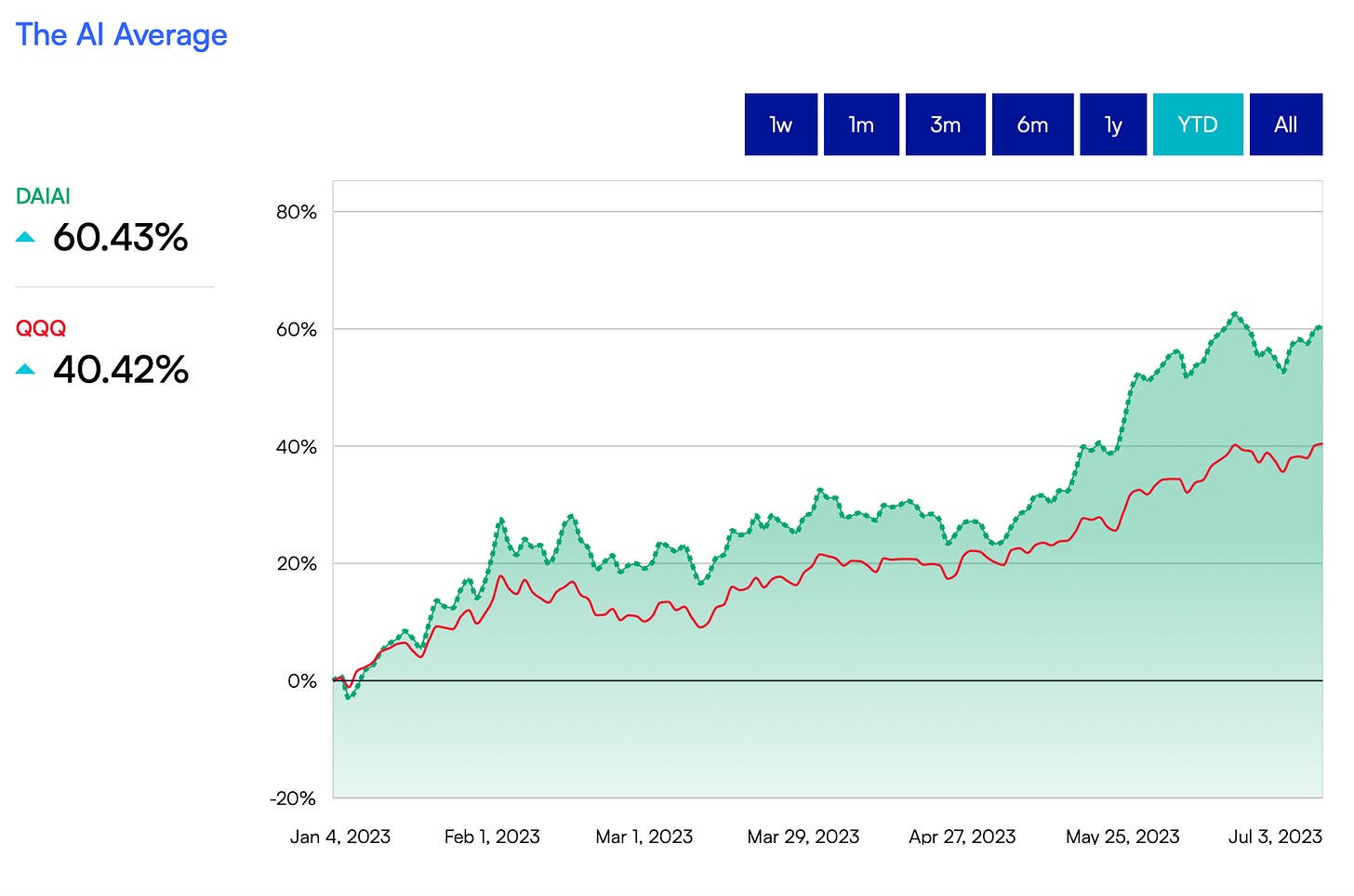

The AI Average Index (AIAI)

The AI Average tracks 30 blue chip AI companies listed on US exchanges with a market cap over $5 billion. The company’s core product offering must also involve at least one of the following:

AI compute or networking e.g., GPUs, chip fabrication, cloud services, switches, etc.

Generative AI or a large language model for chat

Some proprietary AI model or deployment

AI-focused data management tools and services

Self-driving or other machine automation technology

Companies in the index are selected by via a committee process like the S&P 500. The AIAI is equal weighted across the selection set and rebalanced quarterly. Changes to the selection set can be made at any time if/when constituents no longer meet the above criteria.

Live tracking of the index is available on Thematic here.

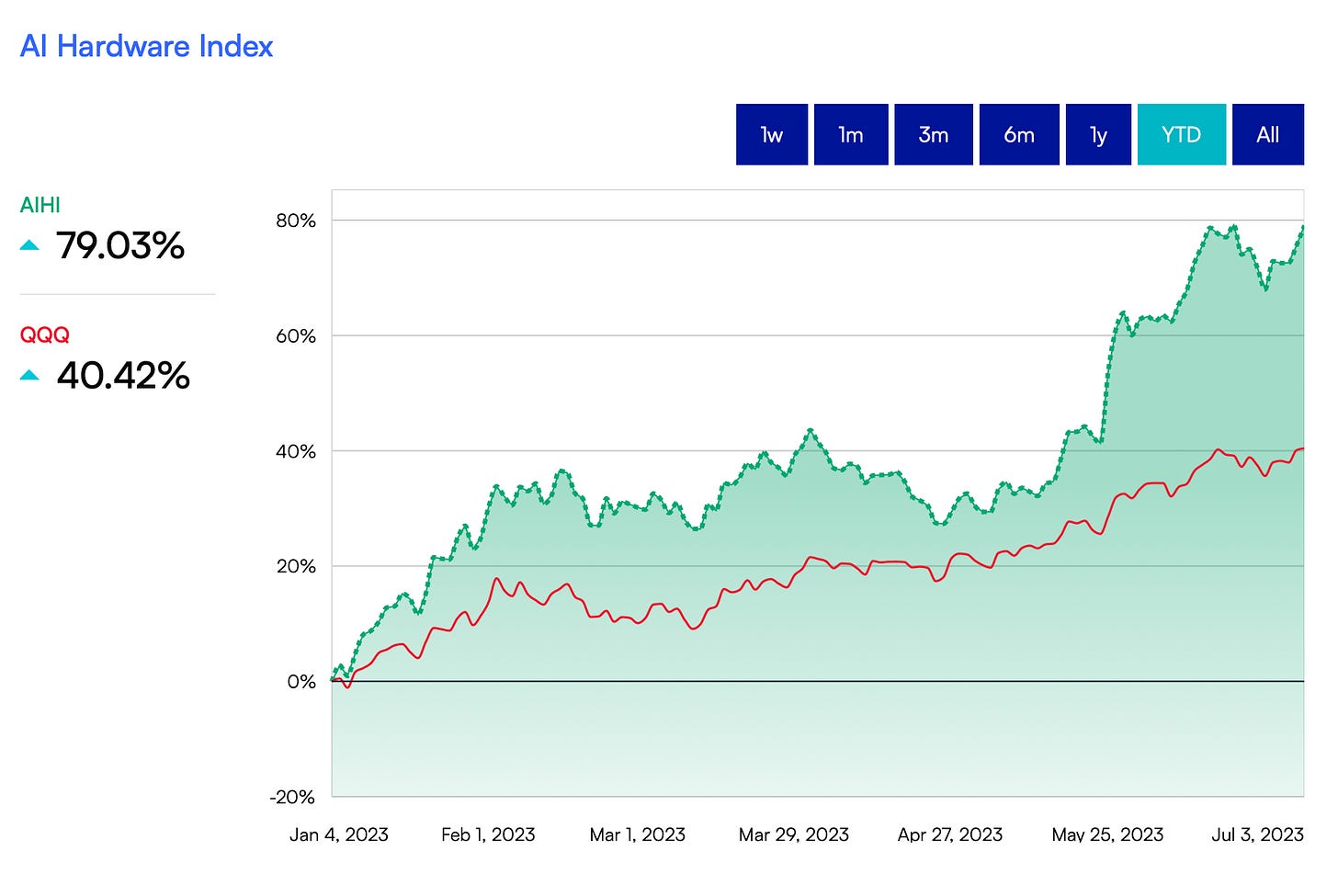

The AI Hardware Index (AIHI)

The AIHI tracks 25 AI hardware companies listed on US exchanges with a market cap over $2 billion. The company’s core product offering must also involve at least one of the following:

AI chip design or fabrication

Memory production

Networking hardware

Vision or sensing hardware

Other AI-related hardware or hardware services such as equipment, server production, or chip testing

Companies in the index are selected by via a committee process like the S&P 500. The AIHI is equal weighted across the selection set and rebalanced quarterly. Changes to the selection set can be made at any time if/when constituents no longer meet the above criteria.

Live tracking of the index is available on Thematic here.

What’s Next?

Intelligent Indices will continue to expand its use of AI to create intelligent market benchmarks as superior comparisons to AI-driven investment strategies. Subscribe to The Deload for updates on all of our Intelligent Indices.