Battle of the AI Stock Pickers: ChatGPT vs Bard vs Claude

Guess which Gen AI won best stock picker so far

The Deload explores my curiosities and experiments across AI, finance, and philosophy. If you haven’t subscribed, join over 1,500 readers:

Disclaimer. The Deload is a collection of my personal thoughts and ideas. My views here do not constitute investment advice. Content on the site is for educational purposes. The site does not represent the views of Deepwater Asset Management. I may reference companies in which Deepwater has an investment. See Deepwater’s full disclosures here.

Additionally, any Intelligent Indices strategies referred to in writings on The Deload represent strategies tracked as indexes that are not investable. References to these strategies is for educational purposes as I explore how AI acts as an investor.

Who’s the Best AI Stock Picker?

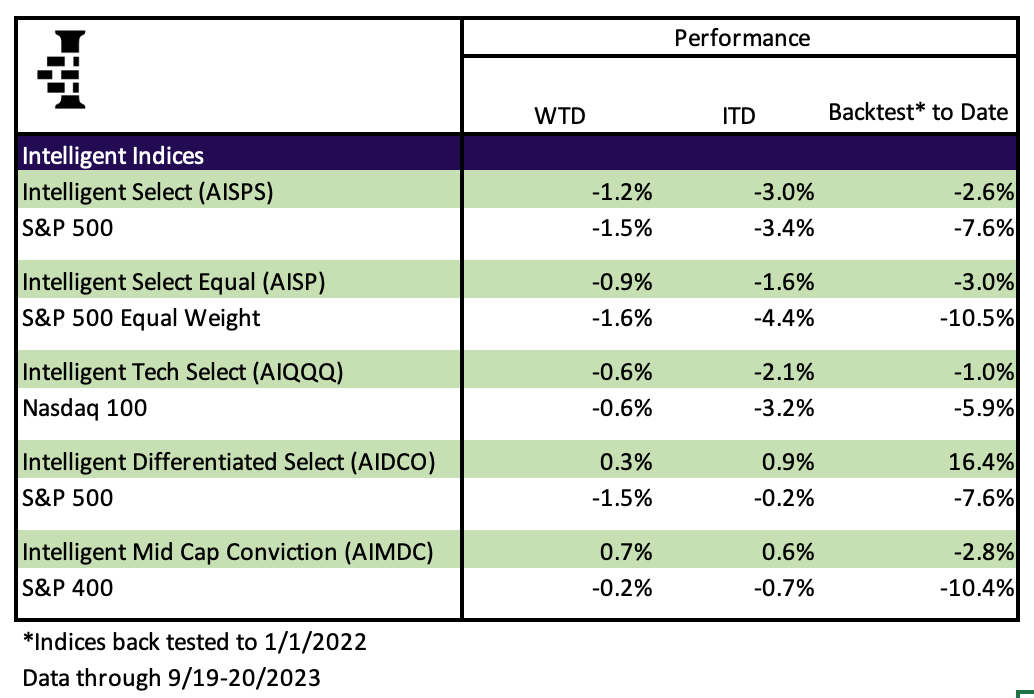

I’ve been testing generative AI to build investment strategies aimed at outperforming legacy benchmarks. The scorecard has AI in the lead. In some cases, substantially:

My process is consistent across strategies. I use ChatGPT, Bard, and Claude as my AI investment committee to select and weight stocks given certain criteria like market cap, sector, geography, and other factors. We’ve even adopted two Intelligent strategies at Deepwater. One is a concentrated Large Cap Tech fund. The other is a Long/Short fund. I believe Deepwater is the first firm in the world to use generative AI to power investment strategies. We invest in where the world is going with the technology taking us there.

In creating over 30 distinct AI-powered investment strategies, I’ve had hundreds of conversations with generative AI tools about stock picking. It’s clear that both the nature of the investing task is “understood” by the AI, and the opinions of what would create the best portfolio to outperform a benchmark are different despite feeding each AI the same data and same instruction set. Comparing the AI committee selection sets is like what you would expect from a human committee: There are some consensus favorite stocks, some non-consensus big bets, and other varied picks.

These different styles amongst the Intelligent Indices AI committee begs another question: Which committee member is the best stock picker?

Time for a new experiment. It’s ChatGPT vs Bard vs Claude for AI stock picking supremacy.

Rules of Engagement

Here’s how I’ll compare ChatGPT, Bard, and Claude:

The Intelligent Select index is one of the first I created in July when I asked “Can ChatGPT Beat the S&P 500?” To create the Intelligent Select index, each of ChatGPT, Bard, and Claude selected and weighted a group of large cap stocks to vote into the index.

I will use each AI committee member’s selections and weightings from the Intelligent Select to compare stock picking performance to date and going forward.

For background, each AI was initiated with the same prompt and same dataset of large cap stocks to create the Intelligent Select index. The goal was to select a set of stocks that the AI expected to outperform the S&P 500.

In addition to certain fundamental factors suggested in the prompt, each AI was prompted to use their own discretion in the selection of at least 50 stocks for the index.

Each AI was also prompted to weight their individual portfolios as they choose.

Which Gen AI is the Top Stock Picker So Far?

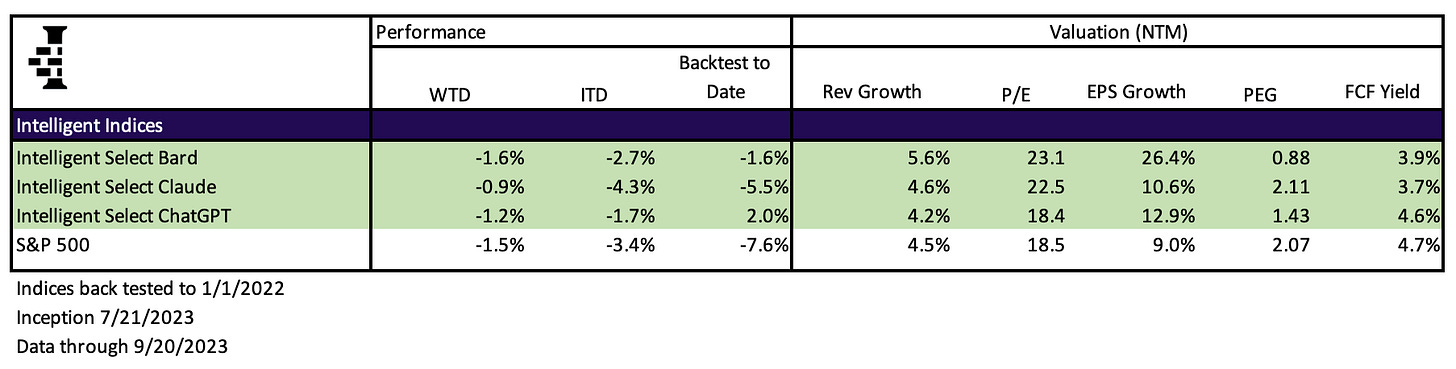

The championship stock picking belt goes to ChatGPT. At least for now. The Intelligent Select parent index is -3% since inception vs the S&P 500 -3.4%. ChatGPT’s selections are down only -1.7%, Bard’s are -2.7%, and Claude is -4.3%.

ChatGPT built the ITD winning portfolio with earnings and FCF multiples similar to the S&P 500 but with greater earnings growth. Bard took the opposite approach, paying up via higher multiples but expecting much faster growth.

These differences in the fundamental characteristics of each AI’s portfolio are indicative of broader tendencies across the AI committee.

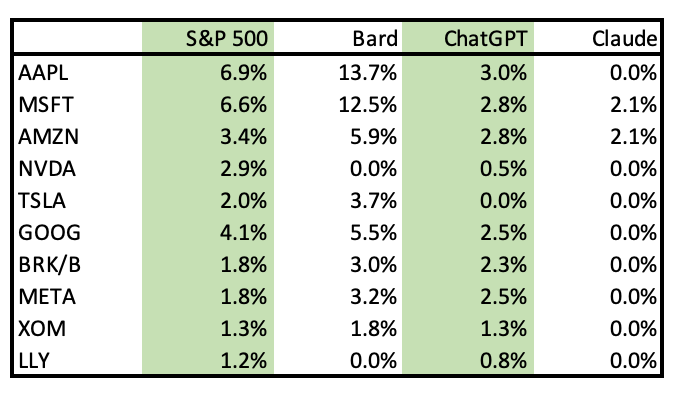

Bard favors tech names and has a much more aggressive weighting approach vs the other two AIs being overweight AAPL and MSFT vs ChatGPT and Claude by ~1,000 basis points. Bard is also meaningfully overweight AMZN, GOOG, and TSLA vs the other two.

Bard’s aggressive positioning toward tech also puts it overweight many tech names vs the S&P 500. If tech works, Bard’s portfolio will rip. If the tech rally stalls, Bard will fall behind its peer set and the legacy benchmark.

Claude tends to like contrarian ideas. Claude’s favorite stock is ABBV, which is ~300 bps overweight vs Bard and ChatGPT. ABBV isn’t in the top half of Bard or ChatGPT’s portfolio weightings. Only two of Claude’s top 10 picks overlap with the other AIs — AMZN and MSFT. Bard and ChatGPT have seven of their top 10 picks in common with one another.

Even more contrarian, Claude omits many of Bard and ChatGPT’s top 10 stocks including AAPL, GOOG, META, BRK.B, JNJ, and JPM. So far, Claude’s contrarian picks haven’t worked given Claude is down more than ChatGPT, Bard, and the S&P 500. Claude’s portfolio was down less than the rest of the comps this past week.

ChatGPT feels most balanced between conviction and diversity in its portfolio. ChatGPT has almost 50% of its weighting in the top 25% of the portfolio. Bard is more aggressive at 67.4%. Claude is more diversified, perhaps given its contrarianism, at 40.77%. The delta between ChatGPT’s highest and lowest weighted stocks is 2.5%. Bard has a 13.5% delta between its highest and lowest weighted stocks, and Claude has a 3.13% delta.

Beyond this portfolio battle, I’ve found these tendencies to be consistent in my many exercises with the Intelligent Indices AI committee. Bard often favors tech when it’s part of the strategy, and Bard likes aggressive weightings when it can. Claude often brings the most contrarian ideas in its selections. ChatGPT always feels balanced between creative ideas and temperate weightings.

Just as AIs have a sort of personality, each AI seems to have an investment style as well.

My hypothesis is that some of the individual AI investing style is a byproduct of the differences between the underlying large language models. Some of it is how it might query the Internet for data. Some of it may be an accident.

AI Alpha

ChatGPT is the best stock picker so far, but that’s not the whole story.

Just like humans, the different styles of each AI might lend itself toward better performance in different kinds of investing strategies.

Bard’s heavy favoritism toward tech might have hurt it in the near term as the YTD tech rally has slowed vs other parts of the market, but that favoritism might make the Bard portfolio outperform if the rally in tech isn’t over. Bard’s philosophy might also make it a great stock picker for thematic strategies focused on innovation.

Claude’s love for more unique ideas might play better in a market that rewards contrarian thinking. Claude’s style might also favor small or mid cap names where there might be greater dispersion amongst stocks.

Diversity of approach and perspective makes for a good committee, whether one of humans or machines. Individually, we’ll see which AI proves to be the best stock picker in this experiment, but together, the AI committee is well positioned to challenge the S&P 500 in the long run. Some will just contribute more alpha than others.

Follow the progress of Intelligent Indices on Thematic.

Doug, I am so appreciative of you both doing this research and sharing your findings so far. I have a thesis about how generative AI will impact investing, and reading your posts helps inform and prompt me to think more deeply. Have a great day.