To the AI Bubble Skeptics

Answering the four common doubts of the coming AI Bubble 🫧

The Deload explores curiosities and experiments across AI, finance, and philosophy. If you haven’t subscribed, join nearly 1,800 readers:

To the Haters

Great investments come from high conviction ideas.

Conviction must be rare. It’s difficult to find, and it’s often fleeting. An effective investment process must challenge conviction ideas, pick them apart, even make them feel stupid. Sometimes the idea survives in original form. Sometimes the idea reshapes into something new. Sometimes the idea dies.

My strongest conviction idea is that AI will culminate in a massive bubble over the next 3-5 years. We’re in 1995 using the Dotcom boom as a comp, and I’ve been sharing this idea everywhere — social media, at conferences, and most recently on CNBC.

Predicting an AI bubble isn’t some grand stroke of genius. Others recognize the historical precedent for breakthrough technologies to result in bubbles. It’s not rocket science. One idea that distinguishes my view is that I believe bubbles are a required byproduct of any new technology that actually breaks through to mass adoption. A bubble guarantees more than sufficient capital such that every idea is tested to maximize the chances of great products emerging and that every resource is available to maximize broad access to those products.

If AI is to be as meaningful a breakthrough as so many predict, then AI needs a bubble to get there.

I’ve received plenty of feedback on my bubble prediction. Thankfully, a decent part of that feedback has been skepticism. Without dissent, an idea must either be painfully consensus or painfully boring. Neither class of idea has a chance to drive extraordinary investment results.

Here are the four common retorts of AI bubble skeptics.

No Way the Nasdaq 4x’s/10x’s from Here

When sharing ideas in time-limited media like TV and social, you need bite size quotes that help people immediately grasp what you’re saying. Things people can remember. I use the tagline: “We’re in 1995 of the AI bubble.”

Some people, I think often just to be difficult, take the analogy literally. I’ve heard the argument that if the Nasdaq trades at 25x forward earnings now and traded at 100x in the Dotcom peak, then I must believe the QQQ 4x’s from here. Or another is that the Nasdaq 10x’ed from its absolute lows in the 90’s to the peak in 2000.

For those who aren’t aware, analogies need not be literal. When I say we’re in 1995, I’m describing the part of the cycle we’re in now vs the Dotcom bubble.

Will the Nasdaq go higher from here if I’m right about an AI bubble? Likely, but I’m not saying the Nasdaq should 4x from here, nonetheless 10x. Every tech bubble is built on a similar base of a breakthrough new technology, rapid gains in equity value for those companies building it, and a crowd that chases the seemingly endless riches; however, the environments around those bubbles are always different and worth understanding.

In 1995, the five biggest companies in the S&P 500 were Exxon, Coke, Walmart, Merck, and P&G. No tech companies. In 2000, at the height of the bubble, it was Microsoft, GE, Cisco, Walmart, and Exxon. Two tech. In 2024, the top five are Apple, Microsoft, Alphabet, Amazon, and NVIDIA. All tech.

Not only that, but those top five tech companies represent 25% of the S&P 500. That’s more than the 2000 peak. Some assert that means we’re already in a bubble.

The Mag 7 (MSFT, AAPL, GOOGL, AMZN, NVDA, META, TSLA) trade at an average 32x forward P/E and 3.4% FCF yield. CSCO was 100x fwd P/E at its 2000 peak. Healthy multiples? Yes. Bubble multiples? Only if this is the most pathetic tech bubble in history.

The Mag 7 deserve healthy multiples because they offer persistent growth, strong profitability, and AI optionality few other companies in the world match. Ironically, it’s the connected world created by the prior Dotcom bubble that allows mega tech to create so much value today. The market was right to be excited about the Internet in the 90s, it just discounted cash flows a couple decades too aggressively.

As we enter the AI bubble, tech is already massive and dominant unlike in the mid-90s. The heft of the Mag 7 makes it mathematically hard for the Nasdaq to multi-x over a few years, but the index doesn’t need to 4x for a bubble to occur. I don’t believe owning the QQQ is the way to play the bubble anyway.

I expect the greatest alpha in the AI bubble to come from high-quality, pure-play AI companies in the private markets. That may distinguish the AI bubble from bubbles prior. Private AI companies will eventually make their way to public markets where investors will bathe them in capital, but the biggest part of the post-IPO craziness we witnessed in the Dotcom era will happen in the private markets this time.

We’re Too Close to the Everything Bubble to Go Again

Yes, we’re still close to the memory of SPACs, NFTs, and meme stocks. Yes, that creates a heightened awareness of collective insanity. No, that won’t prevent another bubble. One might argue that the Everything Bubble is a perfect set up for an explosive bubble because it will create a just fresh enough memory to make the majority skeptical of another boom, but that majority is the exact kerosene that ignites the final manic stages of a bubble.

We’re in 1995 of the AI bubble. Fast forward a few years, and the Everything Bubble memory will fade. Envy of AI riches will grow. Demand for AI assets will spike.

But AI bubble believers should also beware.

The recency of the Everything Bubble may make later participants skittish. Perhaps we’re all more aware of the game at hand, and that makes everyone ready to exit bubble bets sooner than we might otherwise. Whereas the rule of thumb with prior bubbles is just when you think it can’t get any crazier, the bubble lasts about another 12-18 months, that timeframe might compress to something like 6 months for the AI bubble.

By the way, I got this notification about Dogecoin on my phone today, which still has a $12 billion market cap.

Are our memories really that long?

Private AI Companies are Struggling/Overvalued

Because of the recent Everything Bubble, AI bubble players may focus more on high quality, pure-play companies rather than anything with an AI story. Most of those companies are still private, but that’s where I think the best alpha lives.

My bullishness on private AI companies evokes two kinds of detractors:

Ones that believe private AI companies are already overvalued.

Ones that believe private AI companies are struggling.

As for being overvalued, consider OpenAI, the private AI poster child.

OpenAI is doing a tender offering at a valuation of $86 billion. The Information reported that OpenAI hit a $1.6 billion revenue run rate in December, so 2024 revenue could be something like $3.2 billion. At $86 billion, OpenAI trades at 27x forward revenue growing about 300% y/y. That’s a big multiple, but that’s also big growth. NVIDIA trades at 15x forward revenue growing 60-something percent. Snowflake trades at 15x forward revenue growing 30-something percent. I could go on.

You might argue public tech is expensive, and those multiples aren’t reasonable. Maybe, maybe not. Time and the market will decide that. The point is that OpenAI isn’t trading at some exorbitant price relative to its growth given public comps. Valuations for several other private AI companies follow a similar pattern.

Regarding struggles at private companies, these are inevitable on an idiosyncratic basis. There have long been rumors about certain private AI companies, notably Stability AI.

I don’t know what’s going on there, and I won’t speculate.

Given how fast AI is moving, private AI companies that hit turbulent waters may see rapid talent drain as employees jump ship to another AI play that’s more promising. AI talent is scarce, and the talent knows it. We probably see some sudden AI unicorn flameouts. Maybe even some that surprise us all.

All of this supports the thesis of quality. The AI companies who are winning and have the right to keep winning will see their valuations rise rapidly, talent will flock to those companies, and a virtuous cycle will result.

A Long Wait

My favorite pushback (if you can call it that): If we’re in 1995, it’s a long time to wait to get to 2000.

Maybe impatience is another byproduct of the Everything Bubble. Markets don’t have time to wait for capital to build up, innovation to happen, and excitement to grow into fever then into mania. We want our bubbles now, dammit!

The ride up on a bubble is the whole point. We should savor it, not wish for an instant rise and fall.

During the Dotcom boom, the Nasdaq was up 443% from the beginning of 1995 to the beginning of 2000. The annual returns were:

1995: 40%

1996: 22.7%

1997: 22.2%

1998: 39.8%

1999: 84.9%

Is four years a long time? Maybe, but it won’t feel like it if you can structure a portfolio that’s gaining 30-40+% annually.

Again, I’m not expecting our current Nasdaq to perform like the Dotcom Nasdaq. The AI Nasdaq is in private markets. That’s where I think we find returns like the Dotcom Nasdaq.

That brings us to the end of the bubble. The Nasdaq lost 70% between 2000 and 2003. The AI bubble will burst too. The burst is also a necessary part of every breakthrough technology. We must return to sanity where real companies actually create value without the distraction of all the bad ideas funded in the mania.

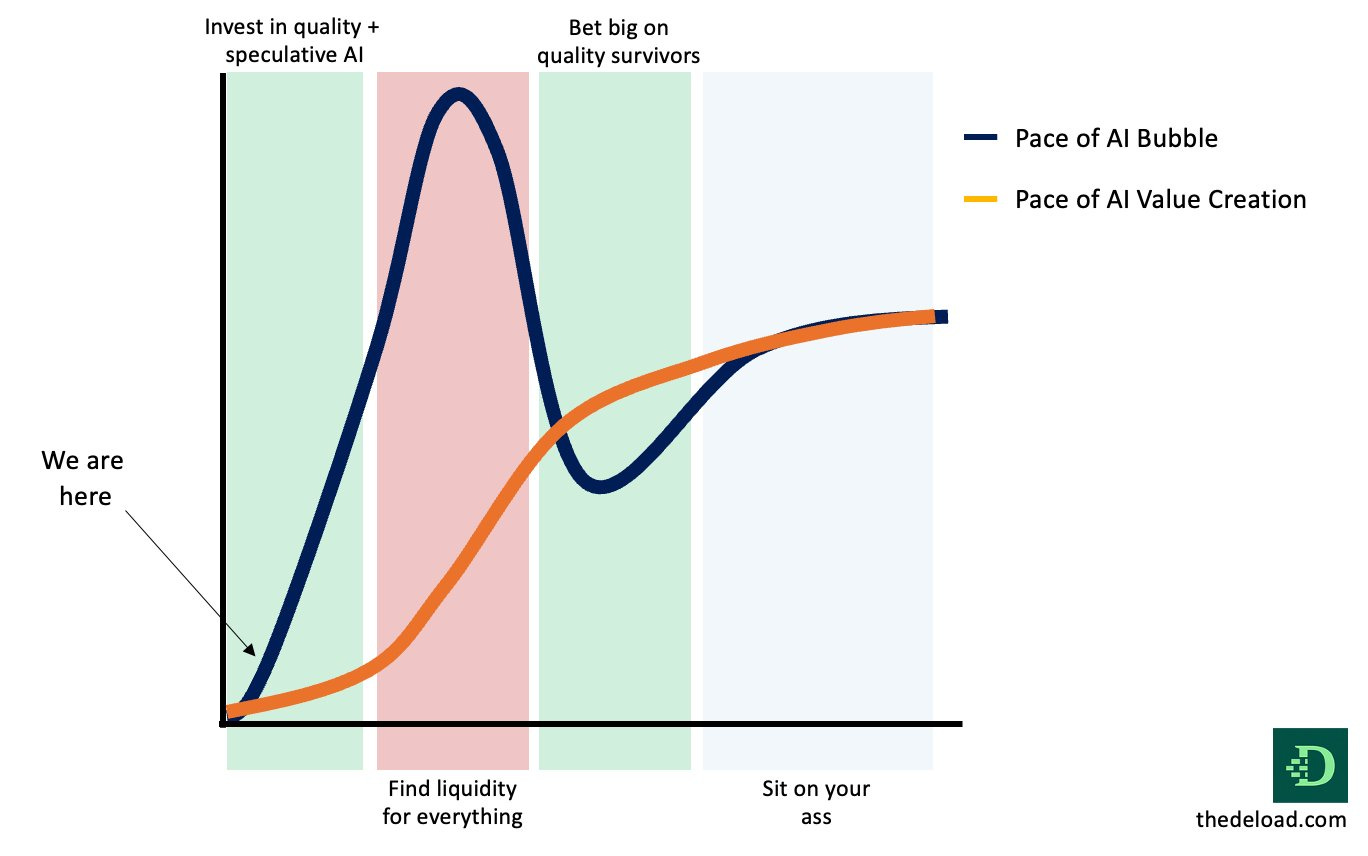

Remember the playbook: Invest in high-quality AI winners. Find liquidity when things feel insane, even if you’re a little early. Wait out the carnage of the decline. Short the worst “AI” companies if that’s in your skillset. Be ready to buy high quality companies back at depressed prices when no one ever wants to hear the word AI again. Then enjoy the compounding of great AI companies that grow into dominant tech giants, just as we saw with the Internet boom.

Disclaimer: My views here do not constitute investment advice. They are for educational purposes only. My firm, Deepwater Asset Management, may hold positions in securities I write about. See our full disclaimer.

To the Doubters of Intelligent Alpha

Some people tell me they’re skeptical of Intelligent Alpha. Rarely more reason than that. They just don’t believe generative AI can beat markets.

Well, the results are the results. Almost all of my 15 core AI-powered strategies are beating benchmarks:

Sometimes the doubt is specific: If generative AI is so good at investing, why won’t others just copy Intelligent Alpha?

Action is an underrated moat. Anyone can do a lot of things. Most people don’t do anything.

And it’s not just one action. Anyone who wants to use AI to invest effectively will have to test different prompts, different foundation models, different datasets. Not only that, anyone who wants to beat Intelligent Alpha will need to be obsessed because I am.

AI is the future of fundamental investing. Every week I grow more convinced of it. The doubters only convince me more.

I hope your other readers are enjoying the prescient advice you are personally sharing. Your paragraph towards the end of your article starting with 'Remember the playbook' is so accurate. For those who can't stay focused; print that paragraph and tape it to the bottom of your computer screen so you can see it everyday!

I believe you're right that new AI companies will also largely be capitalized by venture capital companies long before little guys like myself can play, but I also think that the evolvement of AI will be absorbed by our current large platform companies or possibly, they will be consumed by a new AI company. We're still going to need to reach out through the internet to access that AI. I'm a believer!

I’d say the orange line is more like series of S curves