AI is Bound to be a Better Investor than Humans

And my 5 favorite AI-powered investment strategies

The Deload explores my curiosities and experiments across AI, finance, and philosophy. If you haven’t subscribed, join nearly 2,000 readers:

Disclaimer. The Deload is a collection of my personal thoughts and ideas. My views here do not constitute investment advice. Content on the site is for educational purposes. The site does not represent the views of Deepwater Asset Management. I may reference companies in which Deepwater has an investment. See Deepwater’s full disclosures here.

Additionally, any Intelligent Alpha strategies referred to in writings on The Deload represent strategies tracked as indexes or private test portfolios that are not investable in either case. References to these strategies is for educational purposes as I explore how AI acts as an investor.

AI’s No Midwit

“Invest first. Investigate later.”

Soros said it. Druckenmiller repeated it. Few ideas have proven so true in my experience as an investor.

The longer you play the game, any game, you develop a gut instinct for what works. With experience, your gut is often right, and your mind catches up later. The challenge with investing is that your mind often doesn’t figure out that your gut was right until a stock is up 50% in your face. Then the $100 stock that’s now $150 isn’t the no-brainer your gut saw three weeks ago. If only you had no brain. At least not a human one.

As I’ve experimented broadly using AI to pick stocks, I can’t shake a recurring idea: AI is bound to be a better investor than humans simply because it’s not human. AI is neither gut nor brain. There’s no separation. AI’s gut is its brain, and its brain is its gut. When I have AI act as an investor, its brain doesn’t paralyze before the seeming need for analysis.

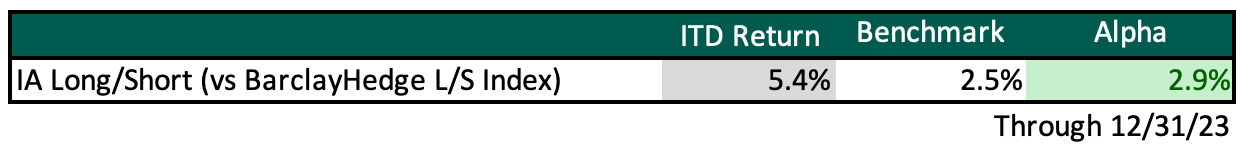

AI skeptics might assume this means that AI is dumb, all gut and no brain, but whether the lack of separation between idea and action makes AI dumb or smart is the wrong question. The important truth is that AI has a persistent advantage because it isn’t the overthinking, emotional midwit human. In time, AI will no doubt meet any definition of “smart,” and it’s already doing well across markets of all types (see the latest inception-to-date performance below).

As the parent of Intelligent Alpha’s 40+ AI-powered investment strategies, I think my AI investment committee falls on the Jedi scale of the midwit meme. All parents think their children are smart.

Which of my AI strategies is the smartest?

There are five that stick out to me as particularly promising for different reasons. Each have taught me a different lesson about AI as an investor:

IA Long/Short

IA Equal Select

IA Small/Mid Cap Conviction

IA Asymmetric Select

???

Here’s why.

IA Long/Short

My AI long/short strategy modernizes Tiger founder Julian Robertson’s timeless strategy from the past: own the best, short the worst.

Owning the best and shorting the worst yielded incredible returns in the 80s and 90s, but success breeds competition. Growth in hedge funds over the past several decades made simply owning the best and shorting the worst tougher as a vehicle for major outperformance. Not only that, the incentive structure of hedge funds — earning a portion of the excess profit — invites more exotic approaches. Now funds try to juice returns with additional leverage through derivatives, playing momentum games, and doing other things that don’t involve simple fundamental opinions of best vs worst.

AI doesn’t feel performance pressure, incentive pressure, short squeezes, or any of the other stress that comes from playing the long/short game. I believe that non-human advantage will enable solid performance over time.

We started running the IA L/S strategy with partner’s capital at Deepwater in Q4. In that quarter, the strategy gained 5.4%, which exceeded the BarclayHedge Long/Short index by 290 bps. YTD, the strategy is up 6%, and that’s what I’m particularly excited about because I made some recent adjustments to how I teach my AI committee about what is “bad.”

In the first iteration of the strategy, mu AI committee seemed to view high growth, high multiple, lower margin stocks as bad companies. Could those be bad companies? Yes, but not always. Many are solid growth companies that deserve some premium. Those types of companies often prove the most maddening shorts because they’re good companies that just appear expensive but aren’t. Bad companies should be stuck in secular decline, face operating issues, and have difficult competition, not just seem expensive.

The new philosophy of my committee seems to be working well given the +6% YTD number. About 80% of the performance is from the long side of the book and 20% from the short side. The fund is 50% net long, so we should expect the long side to be providing more of the performance, but the three individual top performing holdings are all shorts: MBLY, VFS, and BA. It was also short INTC which posted disappointing earnings this week.

Correcting for the human inefficiencies that detract from simply owning the best and shorting the worst breathes new life into Robertson’s iconic strategy.

IA Equal Select

Smart beta ETFs hold almost $1 trillion in assets. A huge category with a specific purpose: provide investors with rules-based strategies aimed to differ from and outperform traditional market cap weighted indexes.

Invesco’s RSP, which tracks the S&P 500 Equal Weight index, is the original smart beta ETF. It has almost $50 billion in AUM. Since the RSP’s launch 20 years ago, it’s outperformed the standard S&P 500, although that outperformance has narrowed given the performance of mega cap tech more recently.

What happens when you combine smart beta with AI? You get smarter smart beta. Actually, you get Intelligent Alpha.

Whereas the RSP’s equal weighted S&P 500 approach just flattens the portfolio allocation across the index, the IA Equal Select applies intelligence to its equal approach via its AI investment committee. Each AI committee member selects up to 100 stocks to include in the Equal Select strategy, and each selected stock gets an equal weight with a twist. If a stock gets selected by all three committee members, it gets 3x the base weight. If a stock is selected 2x, it gets 2x the base.

Inception to date, the IA Equal Select is ahead of the RSP by 570 bps. The IA Equal Select is even ahead of the SPY by 100 bp, no easy feat given the massive contribution from the Mag 7 which is definitionally underweighted in the Equal Select. AI has won so far via superior stock selection with 2-3x base weights in much of the Mag 7, AMD, COST, MRK, and other strong performers since the summer.

The IA Equal Select shows that creative fund structure can help augment AI’s stock picking powers. I believe the combination of committee-based equal weights + intelligent stock selection gives the IA Equal Select a chance to continue to outperform both the RSP and the SPY over the long run.

IA Small/Mid Cap Conviction

Conventional wisdom is that small and mid cap stock picking is less competitive than large cap. The markets are less efficient because of less competition with less capital. The numbers agree. Sort of.

Through June 2023, almost 75% of small cap managers beat the S&P 600 over the prior year, but only about 25% of mid-cap managers beat the S&P 400. Five year metrics show that just under half of mid-cap and small-cap managers beat their benchmarks over a five-year period while only 15% of large-cap managers do. There is some truth to the story of small and mid being an easier game, but it’s still a hard game.

The odd thing about s/mid cap managers is that after the five-year mark where we see the greatest percentage beating benchmarks, the average manager’s deteriorate. My theory is good s/mid cap managers who prove themselves with a five year track record often graduate to large caps where they can manage more money with a greater fee base. The average number of managers who outperform the large cap benchmark suggests the s/mid cap manager graduating is a mistake, but incentives rule the world, and more money is the basest incentive there is.

Back to AI’s fundamental advantage: AI doesn’t feel the temptation to go from being a few hundred million dollar small cap manager to a multibillion dollar large cap one. AI is happy to manage small caps until the end of time, and it does a pretty good job finding alpha in those market caps too. Actually, AI does a pretty good job finding alpha everywhere.

For several core Intelligent Alpha strategies, I run two portfolio constructions: Select and Conviction.

Select portfolios are weighted by the three member AI investment committee, each member receiving equal weights to their selected weights (i.e. 1/3 weighing to each committee member’s individual portfolio). Select portfolios are meant to be broad market representations and replace indexed strategies. Conviction portfolios represent the top 30 selections of the AI committee, 10 from each member, equally weighted.

The Conviction portfolios uniformly outperform both Select portfolios and benchmarks inception to date. It seems AI is a pretty damn good stock picker, and it won’t get the wanderlust to play a bigger game.

IA Asymmetric Select

A few months ago, an industry contact suggested I build an AI-powered portfolio of stocks with 2x upside vs downside. Ok, done. That’s the beauty of the flexibility in using generative models as an investment committee. I can tweak and repurpose the base philosophy I submit to my AI investment committee to hone in on certain characteristics, like finding asymmetric opportunities with the AI Asymmetric Select strategy.

IA Asymmetric Select chooses a portfolio of 50 stocks that my AI investment committee believes has 2x+ upside potential vs downside potential. Inception to date, the strategy is ahead of the SPY by 610 bps.

The Asymmetric Select portfolio includes a diverse array of stocks including big tech winners like AMD (a universal AI favorite) and NFLX, as well as decidedly non-tech companies like TJX, KR, and SBUX. It even included BA.

Wait, isn’t AI short Boeing?

It is, but that’s another lesson: Even though I use the same AI tools for every committee, each committee has a different personality and perspective on the world because of the role I ask them to play.

The Long/Short committee is asked to find the best and worst companies. The 2x upside committee is asked to find stocks that have the potential for 2x or more upside vs downside. Those 2x potential stocks may be some of the best companies, or they may be some of the worst. In the case of BA, the 2x committee seems to have gotten it wrong, at least for now. Maybe BA will recover and still prove a good pick for the Asymmetric strategy. As always with markets, time will tell.

???: The Next One

Seven Super Bowls over a two decade career, Tom Brady always said his favorite ring is the next one. Brady loved the journey. The process of figuring out how to win. The game of adapting to new challenges. When you stop learning, you stop evolving. When you stop evolving, you start dying. This is true for people as much as it is for companies, ideas, and dreams.

The Next One is the only appropriate favorite for a dream that has continued life, whatever the next may be. Only at the end of a journey can a list of favorites be final.

My mission of using AI to challenge benchmarks is still only at the beginning. My lab is overflowing with ideas, and generative AI is still so new. There will always be new models, new philosophies, new ways to combine AI-powered strategies with human creativity. Markets are infinite, so too is the journey for Intelligent Alpha.

My favorite AI-powered strategy is always the next one I dream up.

To quote Brady again: LFG!

Thanks Steve Van Sloun for the inspiration for the midwit idea.

I like your arguments and believe your supporting numbers. I also have a hundred questions of, if and how your intelligent constructs review the stock population and how often you "interfere/modify" the process. How do you gauge when 'fools rush in and smart money gets out'. There are so many variables that enter the picture I wonder how detailed your program is with this regard and how you weight those variables. I wish I was your age and had more of that LFG energy. I'm playing the game individually, but I can't help but agree with you that a well-designed AI is going to beat me. I also don't think a good AI construct is passive, but neither am I.