Unconventional Expertise

Win in AI and life with the non-consensus approach

The Deload explores my curiosities and experiments across AI, finance, and philosophy. If you haven’t subscribed, join over 1,500 readers:

Disclaimer. The Deload is a collection of my personal thoughts and ideas. My views here do not constitute investment advice. Content on the site is for educational purposes. The site does not represent the views of Deepwater Asset Management. I may reference companies in which Deepwater has an investment. See Deepwater’s full disclosures here.

Additionally, any Intelligent Alpha strategies referred to in writings on The Deload represent strategies tracked as indexes or private test portfolios that are not investable in either case. References to these strategies is for educational purposes as I explore how AI acts as an investor.

Unconventional Expertise

Expertise is overrated.

To be considered an expert, one must know the things expected of an expert, and what’s expected is conventional. The doctor, the lawyer, the pilot, the financial advisor. They’re expected to play by a common set of principles based on accumulated knowledge established over time.

The point of embracing conventional knowledge is to produce expected, acceptable outcomes. It is not to product unexpected incredible outcomes. Extraordinary outcomes and breakthrough discoveries only come from unconventional experts.

In my very first post on The Deload, I wrote about the core concept that prompted me to start writing: Non-consensus ideas are the only path to achieve extraordinary results in anything.

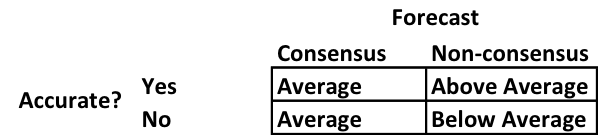

The demand to find non-consensus ideas was inspired by Howard Marks who explains the results of consensus vs non-consensus investment forecasts via a simple matrix:

If unconventional experts are the only source of extraordinary results, that begs three questions:

How do we find unconventional expertise?

What does unconventional expertise mean for AI?

Finding Unconventional Expertise

Ironically, those who build unconventional knowledge cannot be seen as experts by the broader world. Unconventional experts must be derided by conventional experts because their approaches challenge established orthodoxy. Unconventional experts are called crazy, nutty, extreme, even conspiracy theorists.

In many cases, those pejorative descriptors are a fair assessment. There are plenty of contrarian opinions in the world. Few of them are built on unconventional knowledge that supports a “secret.”

“Secrets are important truths about the world that other people don’t yet realize.”

— Peter Thiel (via David Perell writing for The Profile )

When looking for unconventional expertise, you must start by looking for ideas outside of the mainstream. Then you have to validate whether there’s unique expertise underneath the crazy idea or just noise.

Unconventional experts share three traits:

An unconventional background. Someone who has experience with medicine but isn’t a doctor. Someone who has experience with rockets but isn’t a physicist or mechanical engineer.

Knowledge from experimentation. Unconventional experts develop their unique expertise by doing, not reading. They are practitioners. Book smart experts are dangerous because they can sound compelling but don’t really know anything for lack of real practice.

Grounded in a curiosity for truth. Contrarians and conspiracy theorists are zealots who defend an unconventional view out of religious adherence. Unconventional experts end up zealots who defend the secret they’ve discovered through action. It’s a fine line, but the reason for zealotry is the most telling signal of who’s nutty and who’s an unconventional expert.

If we want to find unconventional experts, we need to find people with those traits. If we want to build unconventional expertise, we need to build it around those traits.

A recent example of an unconventional expert colliding with a conventional one is Peter Attia, a longevity doctor, interviewing Derek from More Plate More Dates. Derek is a former steroid-using bodybuilder who developed unique expertise about anabolic drugs, peptides, SARMs, and other substances that are too fringe for traditional practitioners like Attia. Like many unconventional experts, Derek gained fame via a cultish following looking for alternatives to conventional wisdom that doesn’t appeal to them.

As Derek’s unconventional wisdom about underground drugs becomes more mainstream, doctors will incorporate it into their practices. That’s the path of every important secret: Eventually the truth can no longer be denied by the conventional experts, and they accept it into the canon of conventional wisdom. An extraordinary result was thus achieved.

AI and Unconventional Wisdom

Just as is true for humans, I believe there are two paths for AI to solve problems: the conventional path and the unconventional path.

The conventional approach to AI today is to load it with conventional data which leads to specialization, much like the conventional human expert. The data heavy approach optimizes for incremental outcomes, and that’s perfectly viable. History is persistent incremental progress marked by moments of extraordinary exponential invention. We need both, but we shouldn’t be under the illusion that using AI in conventional ways will yield extraordinary outcomes simply because it’s AI.

The unconventional approach to AI is to embrace its inherent creativity by providing less data.

Data necessitates less creativity because it narrows the set of possible solutions. Kids are more creative than adults because they have less data about the world in general. To get extraordinary outcomes from AI, we need to treat it more like a child than a super intelligent machine.

Gaining comfort with machine creativity requires a certain philosophy about the intelligence embedded in modern AI.

Ian Buck, an NVIDIA executive that focuses on high powered computing, gave a great assessment of LLMs. He argued that since LLMs are interacting with humans, they need to understand human knowledge. LLMs are fundamentally different than a computer vision model that doesn’t need to respond to human queries, only process the world around it.

The reason we call things like GPT and Claude foundational models is because they are built on a foundation of human knowledge, and that’s fundamentally new. The machine learning approaches to intelligence of the prior decade did not require any sort of human understanding. Those models were built for specialized optimization tasks with big data. That history of ML influences the data heavy conventional approach to AI today.

Now that modern AI has that foundation of human knowledge, it’s capable of creativity that wasn’t possible before. The market hasn’t figured that out yet, but harnessing the unfettered creativity of AI is where the extraordinary magic will happen, not saddling it with a bunch of data like a model from last decade.

Disclaimer: My views here do not constitute investment advice. They are for educational purposes only. My firm, Deepwater Asset Management, may hold positions in securities I write about. See our full disclaimer.

Intelligent Alpha: The Unconventional Approach to Investing with AI

My experiments with Intelligent Alpha to use AI to challenge markets support my conviction that data-light AI use cases will lead to extraordinary outcomes. Competing against both market benchmarks and other AI-powered strategies is the greatest test of the superior approach, and Intelligent Alpha looks great so far.

Inception to date, ~70% of the 30 strategies I’ve created with AI are ahead of benchmarks. In some cases, AI is ahead by 400-500+ bps.

Not only that. My data-light Intelligent Alpha strategies are also performing well against more data-intensive AI-powered ETFs. Our large cap strategies are winning by an average of 420 bps since inception vs comparable AI-powered funds. Our small and mid cap strategies are just behind the value-focused ECML by an average of 50 bps.

In competition against market benchmarks, the conventional data approach hasn’t worked. Best case, I think you end up with conventional results. If you want to use AI to outperform markets persistently, which would be an extraordinary result few humans have even achieved, you need an unconventional approach. The embrace of AI’s creativity vs data-processing prowess is the unconventional approach, and it is the path to extraordinary results in all markets.

The future of investing is intelligent.

Follow Intelligent Alpha on Thematic for updates.

Hi Doug, another great reflection - THANKS! Based on your experimentation with Investment Alpha and others who may follow suit, where is the investment landscape heading? Can anyone harness the unfettered creativity of AI and create the extraordinary magic you mentioned? It is becoming more evident to me that as AI becomes more widespread and embedded in the investment industry, the DIY model looks to empower a far larger universe of investors than we currently have today. This will mean, I reckon, a truer version of personlisation at scale. Moreover, will we witness an accelerated pace of disintermediation in the investment management industry? As I have alluded before, what would index providers (like AMSCI) do in response to these potential changes? Fascinating times. Best, Rafael