The Deload explores my curiosities and experiments across AI, finance, and philosophy. If you haven’t subscribed, join nearly 2,000 readers:

Disclaimer. The Deload is a collection of my personal thoughts and ideas. My views here do not constitute investment advice. Content on the site is for educational purposes. The site does not represent the views of Deepwater Asset Management. I may reference companies in which Deepwater has an investment. See Deepwater’s full disclosures here.

Additionally, any Intelligent Alpha strategies referred to in writings on The Deload represent strategies tracked as indexes or private test portfolios that are not investable in either case. References to these strategies is for educational purposes as I explore how AI acts as an investor.

Inspiration from Elon

In 2006, Elon Musk shared his Master Plan for Tesla::

Build sports car

Use that money to build an affordable car

Use that money to build an even more affordable car

While doing above, also provide zero emission electric power generation options

With 17 years of hindsight, he executed his plan flawlessly. He built the Tesla Roadster. He built the Model S. He built the Model 3. He built grid storage options with the battery tech developed from the cars.

Now Musk is executing on his 2016 Master Plan with goals to expand Tesla’s product line to address all major segments, develop self-driving 10x safer than humans, and to enable your car to make money while you aren’t using it. He’s on his way to delivering on that plan as well.

Before a Master Plan for Tesla, Musk had a Master Purpose: to expedite the shift from carbon-based energy to renewables. A plan without a purpose is just a set of goals. A plan with a purpose is a simple, clear guide to navigate building something new and important. The simple clarity of Musk’s Master Plans inspired me in thinking about how to build a new business, especially one that aims to revolutionize an industry like Tesla did automotive.

I’ve been working on a Master Plan too, and I’ve taken inspiration from the simple clarity of Musk’s Master Plans. My plan is for Intelligent Alpha because I’m convinced AI-powered investing is the future of asset management.

Just between me and you, here it is.

The Master Purpose

Jeff Bezos famously said that you should build businesses around what won’t change, not what is changing:

In our retail business, we know that customers want low prices, and I know that's going to be true 10 years from now. They want fast delivery; they want vast selection. It's impossible to imagine a future 10 years from now where a customer comes up and says, 'Jeff I love Amazon; I just wish the prices were a little higher,' or 'I love Amazon; I just wish you'd deliver a little more slowly.' Impossible.

For Amazon, the Internet was just a mechanism to deliver what customers always wanted — low prices, great selection, fast delivery — in a new format.

The things that won’t change in asset management are as obvious as those in retail. Investors will always want better returns and fair prices. To invoke Bezos, it’s impossible to imagine an investor saying, “I wish I earned a little less on my investments this year.” Never going to happen.

AI is destined to generate better returns than indexes or humans. Indexes can’t beat themselves, and humans can’t beat the indexes consistently.

So, it’s up to AI to deliver on the unchanging desire of investors, and it can deliver. I’ve seen AI’s superiority to indexes and humans over months of data now. Of my 15 focus Intelligent Alpha strategies, 80% are ahead of benchmarks and winning by an average of 430 bps.

AI beats indexes by adding basic intelligence to long-term oriented investment strategies, and it beats humans by simply not being human — eliminating the emotional and cognitive mistakes we make as investors. AI doesn’t worry about timing markets, it doesn’t feel a stock blowing up in its face, nor does it sense the gnawing need to act as a human manager. Lack of human emotion gives AI a persistent edge in investing, and that edge will only grow wider as AI models get more capable.

Given the unchanging desire of investors for better returns at fair fees, the Master Purpose of Intelligent Alpha is clear: Lead the shift in asset management from a world that relies on indexing and human managers to one that relies on AI.

The Master Plan

Elon’s purpose of accelerating the transition to renewable energy demanded the creation of America’s first new car company in decades, Tesla. Intelligent Alpha’s purpose demands a new asset management company. There are only nine asset managers with more than $2 trillion under management. BlackRock is the largest at over $10 trillion.

To create a world that relies on AI for investing, we need to create an AI-first BlackRock — a multi-trillion dollar asset manager that offers a full range of investment products.

Here’s my Master Plan to do it:

Develop a system for using AI to make long-term investments that beat benchmarks.

Create private funds to test the AI-powered strategies.

Create broad access funds to bring AI-powered strategies to the masses.

Use profit generated from step #3 to launch more AI-powered funds.

Repeat until Intelligent Alpha powers > $1 trillion in investments.

If you break down these steps, the Intelligent Alpha Master Plan is simply to create a superior product (steps 1-2) then build a sales engine to market and distribute it (steps 3-5). That’s the soul of every business’ Master Plan.

Product

Intelligent Alpha is already a superior product. The results inception to date convince me of this, but superior products are never finished. A finished product is ripe for disruption and replacement. To invoke Musk again, the only real moat is pace of innovation.

I believe Intelligent Alpha is 6-12 months ahead of anyone else who might try to figure out how to use generative AI to invest. To stay ahead, we just have to keep moving faster than everyone else. That will require persistent experimentation with the top generative AI models in the market, a deep understanding of how those models “think” as investors, and an ability to explain to human allocators what to expect from the various AI-powered strategies Intelligent Alpha creates. Those three ingredients are ultimately the Intelligent Alpha product — a system that maximizes the potential for alpha generation by using the intelligence of modern AI to make investment decisions for any portfolio purpose.

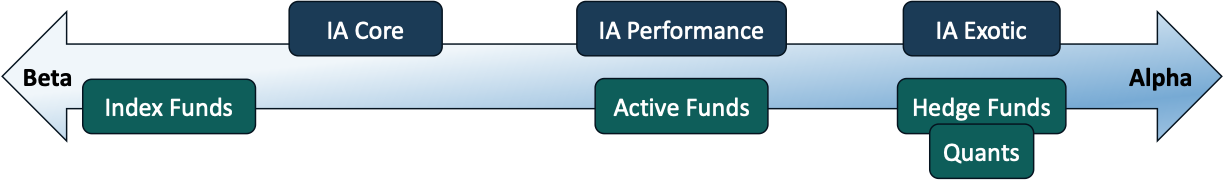

When I think about equity portfolio construction, which is the focus with Intelligent Alpha, allocations fall into three broad buckets:

Core: Broad market beta like S&P 500, Russell 2000, and other index products. Core products create the core exposures in equity portfolios and are most commonly accessed through indexed ETFs. The biggest total asset segment lives here with the lowest fees.

Performance: Strategic allocations that target sectors, factors, and themes with the potential for alpha. Performance products may be indexed or active and come with higher fees than core exposures.

Exotic: Unique investment exposures like long/short equity, special situations, quantitative funds, etc. Exotic products generally target uncorrelated investment returns and are often limited to high net worth clients through limited partnership structures. They often have the highest fees and may include performance fees.

To deliver on the Master Plan to offer broad access to AI-powered investment products, Intelligent Alpha’s products are structured around these major asset buckets. We have almost 10 Core strategies, 30 Performance strategies, and a couple Exotic ones with more in the pipeline. The product is ready.

Sales

Product is critical for a new business. It’s where most entrepreneurs start, but too few think about building a sales engine.

Selling, in all forms, is the conversion of attention to interest to purchase. That’s the engine.

The most powerful tool for an investment product to capture attention and ultimately convert it to purchase is a track record. Prior results are never a guarantee of future success, but they are a fact that some strategy at least worked in the past.

Intelligent Alpha’s 40+ strategies have a soft track record of 6-7 months of solid performance. We’ve been tracking those as indexes. If AI can keep it up, a strong and marketable track record will come in time.

In the absence of a marketable long-term track record, the next best thing to do is create a cult.

Many successful startups create cult followings. The companies foster passionate customer bases who share a common secret delivered by the product. In many cases, that secret powers a part of the customer’s personal identity, making the customer powerful advocates for the product — an unpaid sales team. By creating a cult, a company can short circuit common objections to new-to-market products.

The most inspirational finance cult for Intelligent Alpha is Vanguard.

Jack Bogle built the cult of Vanguard on a simple secret: Accepting market returns in low-fee vehicles was a smarter decision than investing in high fee active products that often underperformed the market. Vanguard customers who embraced Bogle’s secret enjoyed a communal superiority over other investors by enjoying better returns with minimal fees.

Who wouldn’t feel like a genius by getting better investment performance with lower fees?

AI-powered investing is destined to be the next cult in the investment world. AI-powered investing creates a natural us vs them — believers in the power and promise of technology vs the luddites who just want market returns or maybe even worse from human managers. Just like Bogle’s indexing, either you immediately get that AI will provide the greatest chance of persistently outperforming markets through superior intelligence, or you disbelieve the machines will take over. If you believe in the power and promise of AI, there’s only one choice.

No One Else is Coming, It’s Up to Us

I’ve been part of thousands of venture pitches. One of the most natural questions is, “If this is such a great idea, why won’t the big incumbents just do it?”

So, why won’t BlackRock build the AI-powered BlackRock?

Messiness, data, and desire.

No one has experimented with using generative AI to build investment strategies as I have, and it’s messy. It requires adjustments and adaptations that may change daily. It requires creativity in structuring prompts. It requires creativity in structuring strategies. Incumbents often avoid the messiness of new markets and new technologies because they have franchises to protect and other priorities that can grow more easily. If generative AI ever reaches the point where it’s easy to use for building investment portfolios, it will be too late. The procedural messiness tells me the timing for Intelligent Alpha is just right.

Investment industry people curious about generative AI as an investment tool are too data focused. The power of data to create trading strategies is apparent in the success of the best quant investors, but I don’t believe data will be as useful a moat in creating the AI-powered BlackRock. Data necessarily limits how wide a market an investment strategy can address. The more narrow and unique the data, the more narrow and unique the product to come from it. Massive asset management platforms aren’t built on data-driven investment products. Vanguard, BlackRock, State Street. They’re built on simple indexes and infinitely sliced versions of different market segments. If you want to build a niche AI-powered investment product that might generate fantastic returns, build it with data. If you want to build a broad AI-powered investment product, you need to do it beyond data. I have a plan for that too, but I’m not sharing it yet.

The last reason incumbents often miss new opportunities is because they don’t have the same desire as I do. Are they experimenting with generative AI? They should be. Do they have someone who is as curious and passionate about it as me? Probably not. Do they have a mission oriented around transforming the investment world to one powered primarily by AI? Certainly not.

And that’s how innovation happens.

For as much as AI will do for us, it doesn’t yet replace the drive and determination of a human being who believes in a different future. I’m convinced the future of investing is intelligent. Now it’s time to prove it.

Follow along here for the journey.

Disclaimer: My views here do not constitute investment advice. They are for educational purposes only. My firm, Deepwater Asset Management, may hold positions in securities I write about. See our full disclaimer.

Your core thesis seems to be that AI can outsmart the market, while Bogle's thesis was just the opposite: since you can't outsmart it ... buy the whole market. He found a way to execute on that thesis.

But in principle - could it be possible to find a system to outsmart the market? Perhaps. But then in the long run the market would either break or adapt to that system so that its advantage would tend towards zero.

So is the market a random walk on Wall Street? Probably not. It's perhaps rather a distribution machine that directs funds where they are best used to create innovation. Otherwise, how would you explain that the market always goes up. Does this help to select certain stocks, strategies, factors etc.? A good but undecidable question. Because of its over-complexity, the market may still be like a random walk to us.

If you could give us evidence that AI necessarily eliminates its over-complexity and makes the market predictable, then you would have something similar to Bezos' unique selling proposition, since nobody would come up and say "Doug, I love Intelligent Alpha; I just wish the market were a little more complex and less predictable".

Enjoyed the read Doug. You are not one to be sitting still that's for sure. Best to you.