The Case for $1m BTC

The setup that could spark the million-dollar move

The Deload helps you be a smarter growth investor. If you haven’t subscribed, join over 1,300 independent and unconventional thinkers:

Balaji’s Bet

Balaji Srinivasan, a tech entrepreneur that predicted COVID, believes Bitcoin will hit $1 million in 90 days.

His rationale is simple. We’re already in a period of high inflation, and central banks around the world appear to be resuming money printing policies to save troubled banks given a higher interest rate world. The resumption of loose monetary policy will bring hyperinflation, and when hyperinflation hits, it hits fast. And on top of that, many governments around the world are taking harsher stances on crypto ahead of several new centralized platform launches. The Federal Reserve plans to launch FedNow in July, an instant, 24/7 payment network.

Balaji sees Bitcoin as a safe haven in an increasingly locked-down hyperinflation world, which will drive the coin’s price to $1 million. If BTC were to reach $1 million by June, it would be a 40x increase in price in three months. Quite a parabolic outcome.

Most rational people reading this set up will probably think, “No chance.” Even Balaji himself has said he’s “burning money” to do this bet. For him, it’s more about driving awareness to the central bank problem and helping more people get on the Bitcoin “lifeboat.”

No chance was my initial reaction to BTC at $1 million in 90 days, but it’s always valuable to consider what conditions would make the unlikely happen. That’s the basis of extraordinary investment opportunities through contrarian thinking — finding the unlikely thing that actually happens.

I don’t think hyperinflation seems a likely scenario, but there are some interesting structural reasons that a much higher BTC price may not be so crazy.

Narrative + Scarcity = Bitcoin’s Appeal

The underlying mechanism that makes Bitcoin work has always been the combination of narrative and scarcity.

Narrative drives interest and intrigue. The unknown founder. The elegance of the technology. Digital gold. Sovereign money. The alternative to the evil fiat system. The deflationary nature of the coin. There will never be more than 21 million Bitcoins created. The scarcity assists price movement, which enhances narrative. When prices go up, narratives are more easily believed.

Bitcoin’s narrative appears to have current tailwinds that could culminate in a scarcity driven demand vacuum for the asset.

Narrative Tailwind 1: Balaji’s Bet

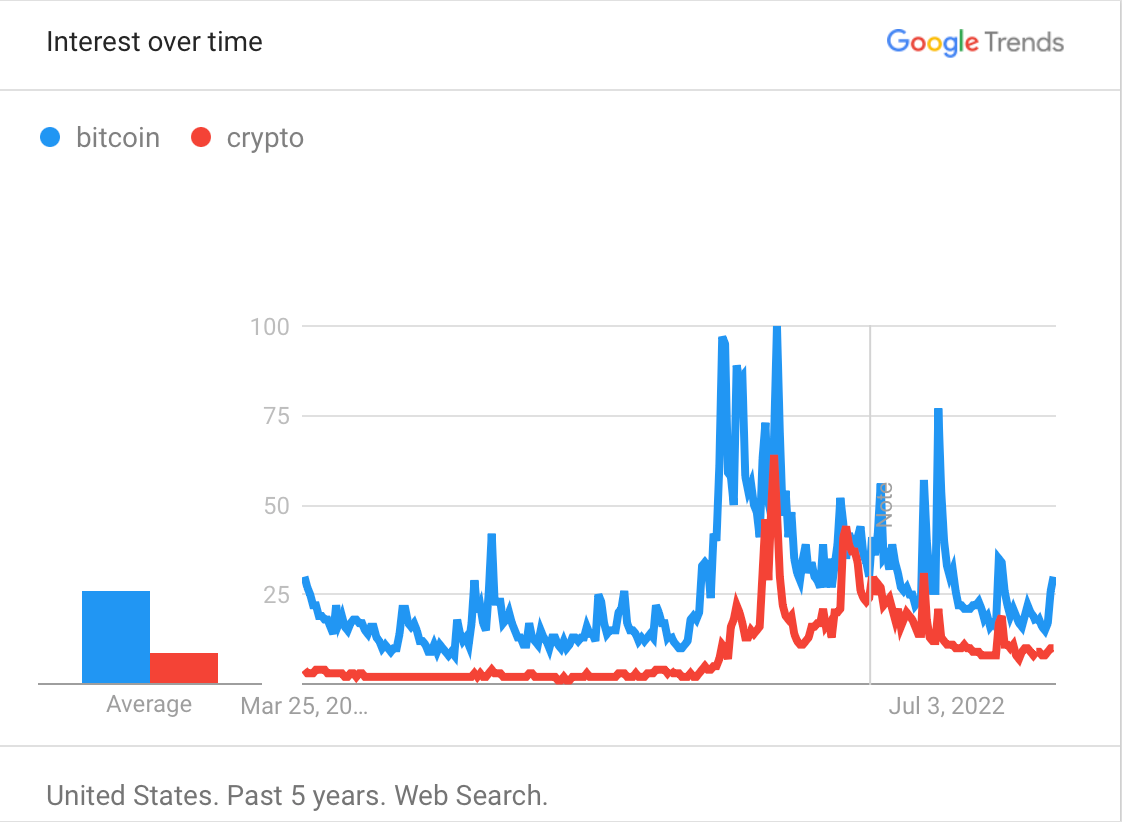

Bitcoin’s first narrative tailwind is that the Balaji Bet seems to have driven some interest in Bitcoin, at least temporarily. Google Trends shows a notable uptick in Bitcoin over the past month. While interest is well below the peaks of the 2021 Everything Bubble, we are near three- and six-month highs in search activity.

Greater interest in Bitcoin means more demand for Bitcoin, which means rising prices, which means more interest and so on. BTC is already up 65% YTD and 35% from March 10th. While some view Bitcoin as purely a risk-on asset that follow tech and other crypto, that hasn’t been the case since mid-March. Bitcoin has more recently decoupled from ETH and ARKK.

It‘s also notable that interest in crypto hasn’t followed Bitcoin over this recent period. The interest seems specific to Bitcoin. Many people still feel burned by the collapse and rampant fraud in crypto markets. I got plenty wrong there re NFTs. Skepticism about broad crypto will linger for a while, but the narrative around Bitcoin is more longstanding and believers more fervent than anyone who chased dog coins or the latest NFT project over the last couple of years.

One of my evolving theses for the next bubble, or at least the next low interest rate/QE period, is that quality assets will benefit most. The next bubble is more likely to resemble the Nifty Fifty era of the 60s and 70s than the Everything Bubble of 2021. Instead of rerunning the same playbook, I think it’s more likely that investors and speculators who think they should pile into assets as money gets cheap again will chase assets like profitable growth companies and top-tier digital assets.

Bitcoin is arguably the highest quality crypto asset. It’s the original. It’s got the strongest brand and religion. If my next bubble thesis is right, investors will eschew low quality crypto alternatives and funnel into Bitcoin instead. Perhaps the current interest is the beginning of the Bitcoin funnel.

Narrative Tailwind 2: Operation Chokepoint 2.0

The second narrative tailwind for Bitcoin is that central governments around the world are trying to close off access to crypto.

Mike Solana’a Pirate Wires published a piece on Operation Chokepoint 2.0 in February (by Nic Carter), which detailed how the US government might marginalize crypto through pressure on the banking sector.

In the article, Carter outlines a host of actions taken by the government against banks that engaged in crypto activities. Since February, there’s been even more profound difficulty for crypto:

Crypto-friendly bank Silvergate is operationally troubled. Silvergate operated SEN, one of the two major onramps between the fiat economy and crypto. The bank shut down SEN as it attempts to survive.

Signature Bank was shut down by regulators. Signature Bank operated Signet, the other major onramp between the US fiat economy and crypto. Signature Banks assets have since been acquired by New York Community Bancorp, although the crypto assets were not included.

Some have speculated, including Signature Bank board member Barney Frank, that Signature’s closure was motivated by anti-crypto sentiment.

The Federal Reserve announced a July launch date for its FedNow Service, an instant, 24/7 payment network. Some in the crypto world have viewed this as a tacit response to crypto and a potential preamble to a central bank digital currency (CBDC).

Coinbase was issued a Wells notice, suggesting that it may have violated securities laws.

Paxos, which issues stablecoin BUSD, was also issued a Wells notice that alleges BUSD is a security.

Whether the US government is strategically trying to harm crypto or not, it certainly isn’t going out of its way to avoid the issue as it seemingly did in 2020 and 2021. Like a good movie, the specter of the government trying to kill crypto adds tension to the narrative sparked by Balaji: The Fed is going to hyperinflate us into oblivious and the Feds are going to make it so you can’t own Bitcoin to protect your assets.

The Scarcity Tailwind

Any time you remove liquidity from a system, you increase volatility because clearing prices are less efficient. There are less buyers and sellers available to find prices. Greater volatility should be expected with decreased access to crypto.

However, for the purposes of evaluating the possibility of a BTC price surge, the more important question is not of volatility but of directional price impact.

A strong case could be made that choking off access to crypto could be a tailwind to BTC prices.

As we’ve said here before, market prices are not set by aggregate demand but by the marginal buyer and seller, meaning the most bullish buyer willing to pay the most and the most bearish seller willing to accept the least. Restricting access probably means two things: The most bullish buyers will still find a way to buy Bitcoin and the most bearish sellers will exit before they get trapped.

Bullish buyers and sellers trapped in a hard-to-access marketplace creates the possibility of a demand vacuum where only buyers willing to pay a high price find access, but the ecosystem is only filled with bullish owners hesitant to sell. The net result may be enhanced scarcity that drives up prices, perhaps aggressively.

Limited access to crypto seems the most reasonable spark that propels BTC to crazy prices in 90 days, and it doesn’t depend on hyperinflation to happen.

Conclusion

An intriguing stage is set for BTC. We have an anti-Fed, hyperinflation narrative augmented by a million-dollar bet. We have the government tightening access to crypto. We have the potential for a demand vacuum that pushes upside volatility.

In some ways, Bitcoin is a sort of both left and right tail insurance. Left tail because if the economy suffers from enhanced inflation, Balaji’s narrative might take stronger hold and drive people to Bitcoin. Right tail because if the Fed suddenly decides to loosen monetary policy, quality speculative assets may benefit. I’d rather bet on Bitcoin taking off in that scenario than many of the broken unprofitable tech companies and SPACs of the Everything Bubble. If we slowly march toward a mild to modest recession, as seems to be the base case for many, BTC probably cools with minimal fanfare.

Still, BTC reaching $1 million in 90 days feels a grand stretch, but the setup is intriguing enough to wonder if something less aggressive isn’t that crazy. BTC reaching $50-100k in 90 days? Perhaps not so crazy in the event of more limited access and resilient buyers.

I would certainly take Balaji’s bet of 1 BTC vs $1 million USDC, but I’d also buy some options on BTC at the same time. Who knows, maybe Balaji will be right again.

Disclaimer: My views here do not constitute investment advice. They are for educational purposes only. My firm, Deepwater Asset Management, may hold positions in securities I write about. See our full disclaimer.

Can you write about firearms and ammunition as store of value