Obvious Ideas Generate the Best Returns

And why AI will be the best generator of obvious ideas

The Deload explores my curiosities and experiments across AI, finance, and philosophy. If you haven’t subscribed, join nearly 2,000 readers:

Disclaimer. The Deload is a collection of my personal thoughts and ideas. My views here do not constitute investment advice. Content on the site is for educational purposes. The site does not represent the views of Deepwater Asset Management. I may reference companies in which Deepwater has an investment. See Deepwater’s full disclosures here.

Additionally, any Intelligent Alpha strategies referred to in writings on The Deload represent strategies tracked as indexes or private test portfolios that are not investable in either case. References to these strategies is for educational purposes as I explore how AI acts as an investor.

Obvious Ideas are the Best Ideas

It’s conventional wisdom amongst great investors that only unconventional ideas generate extraordinary returns. The power of contrarian thinking is the founding inspiration of The Deload. You have to be non-consensus and right to generate returns different than everyone else, so it’s always valuable to challenge yourself when you’re in the majority.

Maybe not if you’re Stan Druckenmiller.

Druck says he made 120% of his profits from obvious ideas. His non-obvious ideas lost 20% (h/t to Phillippe Laffont’s Bloomberg interview).

How can it be that only non-consensus ideas generate great returns, but one of the world’s greatest investors generates all his profit from obvious ideas? Shouldn’t the obvious ideas already be known by consensus?

The answer lies at the intersection of the complexity and duration of an idea.

The Prediction Matrix

All investments are predictions about the future.

Buying an S&P 500 index fund is a prediction that stocks will appreciate over time as a reflection of broad economic growth. Buying T-Bills is a prediction that the US Government won’t go bankrupt in a few months, so you’ll get your principal back plus interest. Buying stock in a single public or private company is a prediction that the company will grow earnings over time, or benefit from some other factor, and that will make the stock increase in value.

Short-term investment performance is harder to predict than long-term performance because the short term is subject to more noise. Buying the S&P 500 with the prediction of long-term economic growth is an easier prediction to make than whether AAPL will beat earnings next quarter. Wild things can happen in the short term that get smoothed out in time, hence the “zoom out” meme of looking at long-term stock charts to ignore short-term volatility.

When we pair patience with easy predictions, we find the greatest investment opportunities because patience is rarely consensus.

Patient, Easy Predictions

Patience paired with easy predictions makes great investors, not finding hard, galaxy brained ideas that are impossible to repeat. How many of the big winners of The Big Short have done anything great since 2008?

Druck didn’t try to predict every quarter for NVDA. He saw the AI boom and knew that NVIDIA was the company best poised to take advantage of it. Easy prediction. He bought it early in the trend and waited.

Buffett often reminds us that his best ideas are obvious, too. He suggests looking for one foot fences to step over, not 10 foot ones. One foot fences just don’t come around that often. They take a lot of patient searching, then patient holding.

The same patience is what lends power to indexing and quantitative investing. Indexes guarantee you get the market return in the long run, which is better than 90% of active managers. Quants apply patience to well-researched factors that should offer excess return if followed for a long enough time. It is patient consistency over time that makes obvious ideas non-consensus, allowing for extraordinary returns.

Patience is the ultimate non-consensus act in investing, but it’s also the hardest act. Humans are naturally impatient. It goes against our wiring to build conviction about something that will take time to prove out. We’ve only got so much time on earth, and we don’t want to spend it waiting. It’s more appealing to chase obvious ideas with impatience, or go after hard ideas that tempt us with greater rewards.

Impatient, Easy Predictions

The worst strategy for investors is to impatiently chase easy predictions. Impatient, easy predictions are a sucker’s game fueled by emotion and instinct. Investors in this category don’t take the time to put enough depth of thought into their predictions to create any unique insight or conviction. The predictions are based on sentiment, momentum, and popular narrative. As a consequence, as soon as those trades look wrong, or even if they look right, many of those investors bail and take the loss or small gain.

Most of the profit from impatient, easy predictions accrues to the investors who stick with the idea patiently or by impatient investors who made the prediction when it was still hard. The impatient easy prediction game is largely not worth playing.

Impatient, Hard Predictions

Many hedge funds and traders play the impatient, hard prediction game because of incentive structures that offer large annual payouts for beating benchmarks. As Munger reminds us, “Show me the incentives, I’ll show you the outcome.” If a manager can make a lot of money for doing well in a given year, then he’ll try to find ideas that will do well in a given year, a definitionally impatient timeframe.

Impatient, hard predictions depend on persistent work to find small edges. A hedge fund might play the quarterly earnings game, betting on winners or losers, or it might play the macro game, betting on interest rate changes or otherwise. If a manager can generate a consistent edge, it can compound over time; however, finding that edge and keeping it requires far more effort and invites the potential for far more volatility than patient, easy predictions.

Patient, Hard Predictions

Venture capital is the quintessential patient, hard prediction game. In venture, you bet on people, who are hard to read, building products for markets that don’t exist, which are hard to imagine. There are no easy predictions in venture. Since private investments are naturally illiquid, you’re forced to be patient — certainly a feature of venture, not a bug.

The difficulty of patient, hard predictions don’t make them bad investments, it just changes how you need to structure your portfolio. Patient, hard predictions come with the most dynamic potential. Venture funds are driven by power law outcomes. 1,000x single investment returns make great funds, not a handful of 10x’s. You want lots of shots at the 1,000x rather than a few “safer” shots at a 10x.

Patient, hard predictions tend to be more abstract and less quantitative in nature, and abstractness requires a kind of creativity and empathy that the other forms of investment predictions don’t. The abstract nature of patient, hard predictions means humans have a natural edge in making them, whereas AI has the edge in the other forms of prediction.

A Prediction About Predictions

Over the next decade, AI will take over the easy, patient predictions made by great investors and quants, and it will also take over the hard, impatient predictions that dominate hedge funds. As with all discussions of man vs machine, the relative strengths and weaknesses of each define which is likely to win and lose.

Humans fall prey to emotions and biases that cloud logic in the context of investment decision making. We want to believe certain narratives, even if the data and environment don’t support them. We feel pressure when we’re wrong, and even when we’re right, and that creates poor decision making. All of this lends to our impatience.

AI is less fallible in logic because AI doesn’t suffer from emotions nor impatience, but it’s not perfect either. AI lacks the unbounded creativity that humans enjoy, often incited by the very emotions that cloud our logic. Creativity is not a logical act, so logic only hampers it.

We could reclassify our four investment quadrants in the guise of creative necessity. Making patient, easy predictions doesn’t require creativity because the ease of the prediction makes it obvious. Obviousness repels creativity. The obvious reality of an easy prediction should be decipherable by AI. Making impatient, hard predictions similarly doesn’t require creativity because the demand of short recognition of the reality of the prediction means it should be built on probabilistic fact rather than creative curiosity. Again, AI’s superiority in logic gives it the edge.

That leaves the abstract nature of patient, hard predictions as the category best suited for humans. And that makes sense. Humans should be better at judging one another on nuanced traits and personalities than an AI that doesn’t understand human nature in the same way.

In all this talk about human bias, I recognize my bias in making the prediction that AI will take over much of investing since I’ve been experimenting with AI to make such predictions for almost a year.

Intelligent Alpha started by targeting patient, easy predictions to build portfolios with the mentality of a great investor buying companies. AI has proven it can make those patient, easy predictions quite well with almost 80% of the 40 strategies I track ahead of benchmarks by an average of 400 bps.

The next phase for Intelligent Alpha is to make impatient, hard predictions. I’ve been in the lab testing Intelligent Alpha’s investment committee — The Alpha Counsel — to make some harder predictions. AI can make these predictions, and I think AI is on its way to doing them better than humans too.

A few examples:

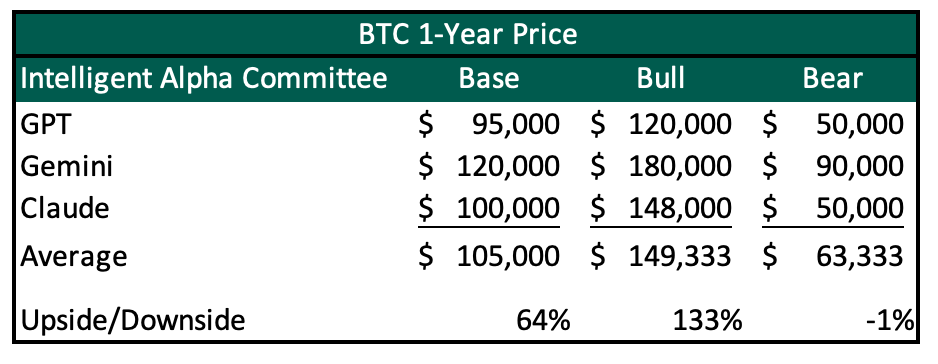

How will Bitcoin trade over the next year?

The Alpha Counsel thinks that Bitcoin will break $100k in the next year with a potential bull case of $150k. The committee notes: "If a pro-crypto candidate like Trump or Kennedy wins, and the administration implements favorable regulations and economic policies, Bitcoin could experience a significant bull run." Seems odds of that outcome have increased dramatically since I polled The Alpha Counsel in early June.

Will the Fed cut rates in 2024?

The Alpha Counsel universally expects the Fed to cut rates later this year. Consensus is for a September cut and an average of two cuts total this year, although there is significant disagreement on the counsel over that number. A less consensus view: Two AIs expect the Fed to cut, then pause for a meeting to reassess.

Time will tell if the BTC and rate predictions are good or not, but my most recent experiment gives me even greater confidence because of strong backtested results.

Several friends shared with me a great research paper from the Chicago Booth school where researchers used AI to predict whether a company would post earnings growth or decline. The study showed that GPT performed better than human counterparts in making earnings predictions.

Since stock price movement is at its most basic level a function of earnings and multiples, if we can predict earnings well, we should be able to create an edge in making impatient, hard predictions. However, we don’t just want to predict whether earnings might go up or down, we want to predict whether they will be up or down vs what’s already priced into the market. Sell-side consensus expectations, while not a perfect representation of what the buy side expects, are a good proxy. So, my most recent experiment tested whether The Alpha Counsel could predict which companies in the S&P 500 would beat consensus revenue and EPS as of the beginning of 2024.

Will company X beat earnings this quarter?

Across four tests in earnings predictions, The Alpha Counsel showed an average of over 65% accuracy in predicting whether a company would beat or miss revenue and 62% accuracy in predicting EPS. In some cases, the accuracy was 70% or greater.

The earnings predictor is still in the lab, but it shows AI’s promise for making impatient, hard decisions.

Predictions vs Actions

Two kinds of investing were left out of our predictions matrix: activist investing and leveraged buyouts.

One of the allures of activist investing and leveraged buyouts is that you aren’t necessarily making a prediction, you’re forcing an action. You have active control of your destiny rather than passive ownership of some stock or index.

When you can determine an outcome, you’re creating a different kind of alpha.

The activist and LBO styles don’t neatly fit into our model for predictions, rather they live sort of adjacent to patient, hard predictions in that they too require abstract thinking and creativity. Activists and LBO operators need to create detailed plans then implement them with people. While AI is well suited to create plans, it’s not well suited to implement them, nor are humans ready to follow.

Maybe AI will take over venture, activism, and LBOs in time, but for now Intelligent Alpha shows AI will win in the easier domains of patient, easy predictions and impatient hard ones.

The future of investing is intelligent.