NFTs: Equities of the Metaverse

Great projects compound value for NFT investors

NFTs reimagine the ownership and distribution layers for goods in a digital world. If you believe in a metaverse where we spend a bulk of our time immersed in a digital world, you have to believe in NFTs. NFTs also reimagine the flow of income from companies to shareholders by treating customers like shareholders.

NFTs Merge Customer and Shareholder

A traditional company creates a product and sells it to customers for cash. After expenses to operate the business, the cash left over belongs to shareholders as earnings. While there are several capital allocation decisions a company can make with its earnings, for simplicity the company either retains the earnings for redeployment into the business, or it distributes the earnings to shareholders as a dividend.

Every new NFT project starts with an initial offering that doesn’t look too dissimilar from the beginning of a traditional company structure. An NFT creator makes a product — the NFT — and sells it to customers. Sometimes the NFT creator even gives away the product for free.

Where things start to diverge is after that offering. Good NFT projects treat initial product buyers like shareholders by offering access to future releases or free products. Holders may collect those new releases or sell them for income, much like a dividend stream for traditional shareholders. As such, NFT creators divert revenue, not earnings, into the pockets of asset holders. This means creators need to find other ways to create self-sustaining projects that compound value for asset holders.

NFT Project Paths

After the spark of a public sale, NFT creators can choose several different paths for expanding the project:

Creators can conduct another public sale, although this is uncommon as it demotes the importance of community. Projects that don’t demonstrate loyalty to the existing community pass negative signal to buyers of future projects.

Creators can do a private sale where only owners of the original asset can purchase some new NFT. Pixel Vault used this tactic where only Punks Comics owners could purchase Mintpasses for the group’s new Metahero project.

Creators can distribute new NFTs for free to owners of the original asset, whether airdropped or for gas fees. Bored Ape Yacht Club (BAYC) airdropped Kennel Club assets to original BAYC holders.

Creators can use a hybrid model that combines a public sale with either a private sale or a distribution to original holders. BAYC airdropped Mutant Serum to its 10,000 Ape owners, then offered another 10,000 Mutant Apes via a public sale for 3 ETH each.

The latter three models are “dividend” models that enable fundamental analysis by NFT investors each with their own pros and cons.

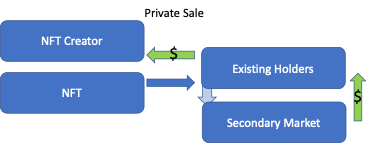

Private Sale

The right to purchase some future asset is more like a warrant than a dividend. When you own a warrant in traditional finance, you have some known strike price relative to a prevailing open market price. The difference between strike and market is your potential profit. The same is basically true for an NFT private sale. The difference between the mint price plus fees and the market price is your profit.

The challenge is that a market likely doesn’t exist for the new asset being privately sold, so NFT investors need to assess the resale potential of a private sale asset vs the cost to buy.

Established projects with strong core assets are generally good bets for investors. Strong communities create demand for new assets with access limited to a small number of existing asset holders. For newer projects without a strong community base, private sales are risky.

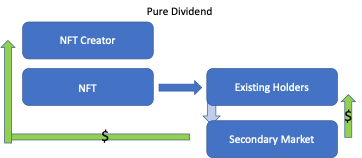

Pure Dividend

Arguably the most shareholder friendly, NFT investors don’t need to think about whether to acquire some new asset when it’s given to them by the creators.

The challenge for projects that issue pure dividends is finding resources to fund future projects since creators don’t receive funds from the sale of assets. Many creators work around this challenge by charging a relatively higher royalty on secondary sales. This additional fee is borne by dividend receivers as a tax on the sale of distributed assets. As long as the royalty is within reason — sub 15%, ideally sub 10% — it shouldn’t be too great a burden to investors.

Balance sheet is always an important consideration for investing in traditional equity, and it should be for investing in NFTs, too. The risk for investors in pure dividend distribution projects is that second market volume can fund the creation of future assets. A project that doesn’t enjoy a somewhat consistent flow of second market volume may eventually find that it doesn’t have capital to reinvest back into new distributions.

Building mechanisms into projects to encourage secondary volume rather than hodling could be a fix for creators with long-term ambitions that want to issue pure dividends.

Hybrid Model

The hybrid model combines a pure dividend with a public sale. While this fixes the resource issue that can plague a pure dividend strategy, it introduces a new challenge that traditional equity investors are familiar with: dilution.

A hybrid model requires the project creators to issue more tokens than a pure dividend model because they have to cover both the existing owner base plus the public sale. In the case of a 10,000-piece collection, this often means issuing 20,000 new tokens in the hybrid sale. Both BAYC and Larva Labs issued 20,000 tokens for their hybrid sales of Mutant Ape Yacht Club and Meebits respectively, 10,000 to core asset holders and 10,000 to the public.

Given a greater supply of total assets being created, the relative value of the hybrid dividend could be less than in a pure dividend or private sale model. This is the tradeoff for de-risking the project balance sheet.

Overall, combinations of the pure dividend and hybrid models may offer the best of both world for long-term projects. Given that the amount of leverage inherent in creating art and communities, a project that has become culturally relevant may be able to fund several years of future projects to be distributed to core asset holders. Yuga Labs, creators of BAYC, generated nearly $100 million from the public part of the hybrid Mutant sale.

Even after paying the team a well-deserved bonus, Yuga will have significant capital to continue to expand BAYC with even bigger projects that could given to core asset holders as pure dividends.

Regardless of which distribution strategy NFT creators choose, good creators compound capital allocated to them by sales or royalties back into new projects. This is no different than good business operators. Investors will always do well to fund the rare creator capable of compounding invested capital, even if it comes to them in the form of jpegs.