NFTs, DCFs, and Institutional Aping

Cash Flow Will be King in NFTs

A month ago, I told some friends that Punks Comics were the biggest no brainer investment they could make. Anyone who bought a Punks Comic in early July is up over 4x in ETH (Ethereum) terms, and more in fiat given the appreciation of ETH.

Punks Comics weren’t a no brainer because I foresaw the current NFT boom coming. It was because I did the thing that you’re not supposed to be able to do with crypto: a simple DCF.

By this point, you should have read Packy McCormick’s great piece explaining the NFT phenomenon in terms of Eugene Wei’s Status-as-a-Service. The point is that humans are driven by status, and NFTs combine two major components of status: social and financial capital. Owning an NFT, like a Cryptopunk, says I’m cool enough to understand this new thing, and I’m rich enough to afford it. Spending thousands on a jpeg is hardly irrational behavior in that context.

The incremental idea here beyond Packy’s work is that NFTs are not only signals of social capital and financial capital, but they can also be literal generators of financial capital. When an NFT creates a return stream to the owner, the NFT can be valued on tangibles rather than intangibles. It’s the difference between buying a share of Apple based on a valuation of future earnings vs YOLOing AMC because its the most recent meme stock.

Cash flowing NFTs are an emerging feature of the space, and a potential source of alpha for NFT investors.

The NFT DCF

"Cryptocurrencies basically have no value and they don't produce anything. They don't reproduce, they can't mail you a check, they can't do anything, and what you hope is that somebody else comes along and pays you more money for them later on, but then that person's got the problem”

- Warren Buffett

Punks Comics are a digital comic book made by Pixel Vault, an NFT-focused content company. The comic was their first project, which told a story based on Cryptopunk characters. The next issue of the comic will be about Bored Ape Yacht Club (BAYC) characters.

In May, Pixel Vault launched the Punks Comic, which could be minted (created and purchased) for 0.2 ETH. At the time, 0.2 ETH was about $720. That may seem like a lot for a comic but not when you consider the future cash flows it could generate.

Unlike Bitcoin, Punks Comics do reproduce.

The Pixel Vault built a unique mechanism around comic ownership that generates future assets for the owner. At launch, users were informed they would have the opportunity to stake or burn their comic after purchase. To stake means to lock up a crypto asset in exchange for some sort of income stream. To burn means to “destroy” a crypto asset by sending it to a wallet where it is unrecoverable.

In exchange for staking a comic, owners would receive $PUNKS tokens over a 24-month period. Those tokens represent a fractional ownership in a vault holding 16 Cryptopunks that were characters in the comic. At launch, those Cryptopunks were worth about 600 ETH. Stakers will earn 50% of all $PUNKS tokens over the 24 months.

In exchange for burning a comic, owners would receive a Founder’s DAO token. The Founder’s DAO owns 25% of $PUNKS tokens as well as other rare crypto assets.

Given these tokenomics, I didn’t even need to do a DCF. If I staked my comics for the full 24-month period and assumed that roughly half of other comic holders would too, then 50% of $PUNKS tokens would be distributed across 5,000 comics holders. One 24-month staked comic would earn 0.02% ownership in the bundle of 16 Cryptopunks worth 600 ETH, which would be worth .12 ETH. (Note: I am excluding gas costs — transaction costs — in these calculations which would have a minor impact depending on timing of mint).

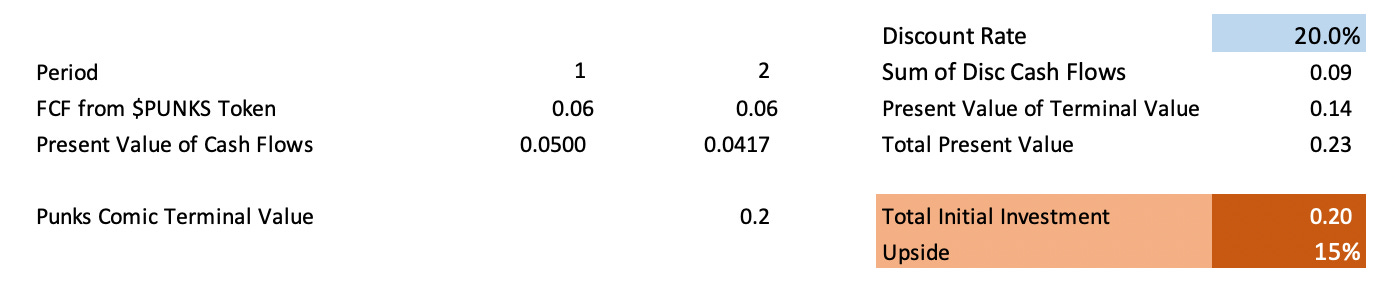

At the 0.2 ETH mint price, 0.12 ETH is a 60% return on investment in two years. For the sake of the DCF argument, even at a 20% discount rate, the investment was 15% underpriced assuming no change positive or negative in the value of Punks Comics or Cryptopunks.

One could argue that the NFT space is volatile, and the value of the assets could change, but that can be true of any financial investment. I believed then and still believe now that both Punks Comics and Cryptopunks will grow in value over time.

Even if you missed out on minting a Punks Comic, you had another shot to buy on the aftermarket backed by similar financial analysis.

In July, Pixel Vault announced plans to launch a new superhero series called Metahero based on new IP to be sold as NFTs. Anyone who owned a Punks Comics on July 15 was given the right, sort of like a warrant, to purchase a Mintpass that can be exchanged for one Metahero NFT in the future.

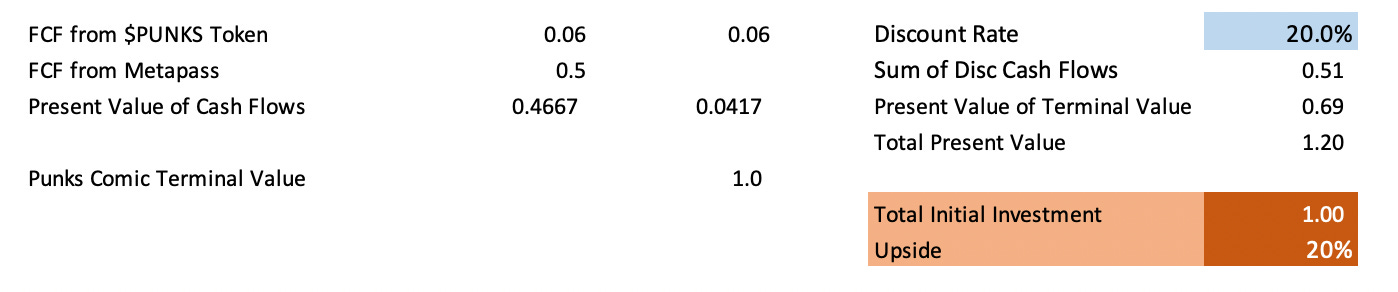

Prior to the July 15 snapshot of Punks Comics owners, Punks Comics were trading at around 1 ETH on secondary markets. We already assume that the $PUNKS tokens that the comic earns for staking are worth 0.12 ETH. I assumed the Mintpass would be worth 0.5 ETH based on other avatar projects in the market. Combining the two assumes a 62% return over two years. Again, even if I discount it by 20%, including a discount on the Mintpass of one year, the asset was 20% undervalued in early July.

Mintpasses are selling for about 2 ETH right now on Opensea, so the actual return on investment has been 200% in one month. No discounting needed.

Emerging markets, like NFTs, create the chance for this kind of alpha because they’re inefficient. Using DCFs and other traditional finance tools will become more commonplace in the NFT space over time, but anyone using them must first accept a critical premise: Internet-native money is money. If you don’t believe in crypto, then investing in NFTs on an analytical basis will never make you comfortable. If you do believe in it, then using even the simplest financial valuation tools can provide edge. At least for a little while.

Assessing NFT Cash Flows

The ability to use traditional financial analysis to invest in NFTs will bring bigger money, and the edge of analysis will fade with it in time. Institutional money is important to NFTs for the same reasons as it has been for crypto: legitimacy, stability, and liquidity. In turn, creators will get smarter about building cash flowing aspects to projects. A virtuous cycle will ensue. We’re seeing the early stages of it now.

There are three tactics emerging for NFT creators to build financial return into assets:

Share a pool of already valuable assets with the community. Parceling out an asset of definitive value guarantees some cash flow to buyers of an NFT project and is the strongest mechanism to attract financial investors. I believe this will also prove to be one of the best ways to build community over time. When creators contribute valuable assets for the community to own, they put real skin in the game. It’s like a management team buying their own stock. Incentives are clearly aligned.

Pixel Vault and the fractionalized $PUNKS vault are the textbook example. The team bet over 450 ETH (75% of the 600 ETH pool plus some other crypto assets) that their project would be successful. If the comic didn’t sell, the team would risk having to placate a smaller community by honoring their word or pulling the committed Cryptopunks and losing reputation. By my estimation, Pixel Vault sold ~2,000 ETH worth of comics, ~500 ETH of Mintpasses after revenue sharing, and ~150 ETH from secondary trading on Opensea alone. It seems like the bet paid off, and they’re just getting started.

Share project revenue with NFT owners. Pixel Vault is also doing this with Punks Comic. They’ve announced that 30% of all Mintpass sales for their Metahero project will go to the $PUNKS vault. Mintpasses sold for 0.08 ETH each, and it looks like about 9,000 will sell for a total of 720 ETH. The 30% that goes to the $PUNKS vault is 216 ETH. With 50% of $PUNKS tokens owned by people who stake, those owners will benefit from an additional ~108 ETH contribution beyond the initial value of the 16 Cryptopunks. That’s about 0.02 ETH more vs an average floor price of comics for a 1% return against a current floor price of 2.3 ETH, or an additional 10% return against mint price.

A variant on the idea of sending sales back to the community is NounsDAO. Nouns are a generative art project where a new NFT is auctioned every day. The proceeds of all sales go into a treasury controlled by Noun owners. You can think of purchasing a Noun like buying into a shared pool of assets with a future purpose to be specified by the community. It’s sort of like an NFT SPAC but controlled by shareholders rather than a sponsor. There should be some expectation of benefit given a proportional vote in the use of the Noun treasury, but it’s harder to draw a direct financial outcome useful to model an investment.

Returning capital to NFT owners will be a major feature of entertainment-based assets. Music, video clips, and even static images can have a stream of royalty revenue that to be shared with owners. The music rights industry already operates in this way, minus the NFTs, although 3LAU tweeted yesterday that owners of his NFTs would be “entitled to cash flows from that music.” It’s starting.

Note: Games where users can make money by playing, like Axie and Zed, fall into a different category. They’re more like jobs than investments, and entrepreneurs can start businesses that employ people to play those games. More on that in a future piece.

Create additional assets for the community. Bored Ape Yacht Club (BAYC) airdropped (gave for free) a dog themed NFT to all BAYC owners two months after the project launched. The dog-themed project is called Bored Ape Kennel Club (BAKC). The cheapest BAKC NFT is selling for 2.4 ETH right now, about $7,200. That’s a 3x return on the BAYC mint price of 0.08 ETH.

Some new NFT projects have caught on to this tactic and promote future airdrops as part of a launch. Project-based currencies or in-game currencies are largely the same thing. The challenge in considering these assets as part of a financial analysis is that their value depends entirely on unknown community demand. BAKC is valuable because BAYC has become culturally relevant. If BAYC hadn’t taken off, BAKC wouldn’t be worth anything. It’s hard to define what projects will and won’t become relevant. Most projects are not BAYC, and the additional assets they create will be worthless when considering future cash flows.

Whether a creator uses investment features to a seed project or not, he must ultimately build something that engages the core community. If the project isn’t of compelling and continued value, the community will fall apart, which means demand will fall apart, and prices will follow. Quality and capability of the team is always the most important thing.

Assessing a Project by Teams

“In looking for people to hire, you look for three qualities: integrity, intelligence, and energy. And if you don’t have the first, the other two will kill you.”

- Warren Buffett

Whatever you think of Buffett’s beliefs about crypto, his thinking on people is unassailable. Beyond financial projections, the success of an investment in any NFT project will depend on the people involved. It is a universal investing axiom to bet on great teams that take care of shareholders. The Pixel Vault team seems to fit that mold, but the majority in the NFT space right now probably don’t.

Booms always bring questionable assessments of future value and opportunists of questionable character. If you can’t trust the team, you can’t trust the cash flows.

Uncomfortable Profit

The NFT space is real, but it’s also probably at peak near-term insanity. I love the space and own NFTs from several projects, but the incremental buyer for the 10,000 unit “art” project of whales or cats or whatever will eventually run out. Projects like Cryptopunks will have long-term value. Most others will fade into irrelevance.

Spendings thousands on jpegs is uncomfortable, bu the opportunity for investors is to bring a financial mindset by seeking projects with tangible future value and ignoring those that are built on hype. Funds will form to invest in NFTs on this basis. The best funds will operate like music rights holdings companies and actively try to create royalty value for NFTs in their portfolios. Hipgnosis, a UK-based songs fund, does this with its portfolio by trying to get Netflix or other creators to use portfolio songs in new content.

Packy even hinted at the potential for this in his piece: “If a Netflix exec sees everyone on Twitter talking about CryptoPunks, they might turn it into a show that rewards the owners.” Whether the value add comes from direct financial compensation or cultural relevance, it is value added to the NFT owners.

Cash flows or not, individual investors should view NFTs as collectibles, and the only margin of safety in collectibles is to buy what you love. If you buy things other people love and the assets end up worthless, you’re left with nothing of even emotional value. If you buy things you love, even if it ends up worthless, you still have something that gives you intangible joy, which is more than you can say for any stock or bond.