Is Google Dead?

The $1 trillion question of search vs AI

The Deload explores my curiosities and experiments across AI, finance, and philosophy. If you haven’t subscribed, join nearly 2,000 readers:

Disclaimer. The Deload is a collection of my personal thoughts and ideas. My views here do not constitute investment advice. Content on the site is for educational purposes. The site does not represent the views of Deepwater Asset Management. I may reference companies in which Deepwater has an investment. See Deepwater’s full disclosures here.

Additionally, any Intelligent Alpha strategies referred to in writings on The Deload represent strategies tracked as indexes or private test portfolios that are not investable in either case. References to these strategies is for educational purposes as I explore how AI acts as an investor.

Google generated ~$700 billion from search over the past five years. I know because I looked it up on…

Google.

It was the 10th blue link in Google’s answers.

Let’s round up. Search is a trillion-dollar prize, and it’s attracted dozens of competitors over the years. Google’s most recent test comes from prior challenger Bing, now powered by OpenAI, and Perplexity. OpenAI is also making direct efforts in search. The growing narrative is that Google is in trouble.

The funny thing is I tried the $700 billion dollar query about Google search revenue on Bing CoPilot with GPT and Perplexity before I went to Google. Neither gave me the answer. Google “knows” everything, more so than any AI-based challengers. The company has been organizing the world’s information for two-plus decades, and it’s pretty damn good at it.

But this post isn’t a takedown of Perplexity or Bing, nor a defense of Google. My goal is to objectively look at our trillion-dollar question: Is Google in danger of dying to AI?

To consider the dangers to Google from AI, I started with a first principles review of why we use search.

My Framework to Understand Search

Search usage fits in a four quadrant matrix. The axes of the matrix are (1) whether the search user has a specific or vague desire and (2) whether that desire has a single answer or many potential answers.

Given those criteria, we’re left with four kinds of search:

Information search: a specific desire and a single answer. What is the capital of Pennsylvania?

Narrowing search: a specific desire with many potential answers. Where should I stay on vacation in Costa Rica? Product commerce searches largely happen here.

Question search: a vague desire with a specific answer. Why won’t my car start? In question searches, you’re one or more layers away from the actual question you need to ask. If your car won’t start because your spark plugs are shot, you need to ask how to replace the spark plugs. Service commerce searches largely happen here because service providers figure out the right question for you, then fix the problem.

Curious wandering: a vague desire with many potential answers. The “I’m bored” category. Curious wandering is a form of search, but social fills the need more than Google. You go to YouTube, Instagram, or TikTok to find something to fill your boredom.

Each of these four forms of search are a form of conversation. Information searches are simple Q&A with a single answer. Exploration and question searches are a one-on-one dialog. Curious exploration is like shooting the shit with a bunch of friends.

Setting aside curious wandering for a minute, information search is the destination of all the other forms of search. When you finally figure out the right question in a question search, that’s an information search. “How do I change the spark plugs in a 2019 Ford Explorer?” When you figure out what hotel you want to stay at on vacation in a narrowing search, that’s an information search. “Four Seasons Minneapolis.”

Even the curious wandering of YouTube and social media can result in a form of information search. Influencers influence fans to buy products, although links to those products are often right in the social app itself. If not, users make the trip to Google. “Logan Paul PRIME energy drink.”

Please don’t go search that.

This is the threat to Google: ChatGPT and LLMs are designed as conversationalists. They’re built for back-and-forth dialogue in a way search engines are not, and the dialogue searches are the most valuable ones.

Show Me the Money

When you know the right question and want a single answer in an information search, 10 blue links is a suboptimal output. Google already knows that.

If you ask Google the capital of Pennsylvania, it just tells you Harrisburg. It’s been doing that for years.

Google also knows real money in search is in dialogues that narrow you focus on specific products or services that answer questions you don’t know how to ask. A website or video that shows how to change spark plugs isn’t as valuable as a click to call a mechanic. Nor is searching Four Seasons Minneapolis. There’s a sponsored link, but brand driven ads aren’t as valuable as the more competitive ads of a search of “4 star hotel Minneapolis.”

Logically this makes sense. If you don’t know exactly what you want or need, advertisers want to pay to influence you. That’s the trillion-dollar reality of search.

For a couple decades now, Google’s one-way, open-ended dialogue via the search box was the best product for consumers hone in on what they want or need. Google will give you a bunch of links that might help, some sponsored, but the answers require a self-directed exploration. If one link doesn’t get you closer to the answer you’re looking for, you go to the next, and the next, and so on. Although Google can usually get you to what you want or need, it isn’t always an efficient experience. Too much work for the human, not enough by the machines.

That’s where AI comes in.

You can ask ChatGPT anything, just as you can Google, but Chat GPT will guide you through a conversation rather than let you explore yourself. More work by the machines, potentially less by the humans. The change from one-way, open-ended dialogues with a search box to guided dialogues with AI is the threat to Google because that experience creates a potentially more compelling way for consumers to engage in commercial searches.

If tell ChatGPT I’m looking for a 4 star hotel in Minneapolis, the AI could ask whether I want to be Downtown or in the North Loop. It could ask what kind of gym I want. Whether I care about other amenities. Through conversation, rather than self-directed exploration, I narrow my search to a specific hotel.

Even more amazing, consider the question of why my car won’t start. An AI might be able to listen to me try to start the car and identify certain issues by sound. Then the AI could suggest either how to fix it or point me to a mechanic that can handle the problem.

As an experience, a conversation with an intelligent machine aimed toward some specific end answer is better than hunting and pecking through 10 blue links. Google knows this too, and it’s been experimenting with combining generative AI and search. The company has been playing with Search Generative Experience (SGE) since mid-2023. It also just launched a revamped, although I still think subpar, chatbot now named Gemini.

Google has been playing in AI, it’s just been maddeningly slow.

Google’s Dilemma

The challenge to Google is not whether it can give good answers or even create chat-based experiences. It’s whether Google is willing to radically evolve its core experience — one with which billions of daily customers are comfortable and familiar.

The pace of Google’s AI innovation suggests they’re erring on the side of caution, and it’s frustrating as both a shareholder (Deepwater currently owns the stock) and a tech enthusiast; however, my review encouraged me to think about the issue from the company’s perspective. Why so slow?

Innovator’s Dilemma is one answer I hear often. Google doesn’t want to kill the trillion-dollar golden goose of search, particularly the questions that are better answered through AI-based dialogue. Just leave it alone and keep printing money.

I don’t think that’s the full story.

Google has a couple billion daily users. Most of those users have been using Google for years. They expect 10 blue links. Suddenly annihilating that experience in favor of a ChatGPT-like experience would confuse Google’s couple billion daily users who aren’t tech-savvy like you and me. A large number of those users have probably never even tried ChatGPT, nor do they care about generative AI.

Google’s slowness in AI seems to exemplify a company stuck in the middle of transition. My interactions with Search Generative Experience range from a fine evolution of search to a mess that tries to bridge the old link-based world with the new gen AI world too carefully.

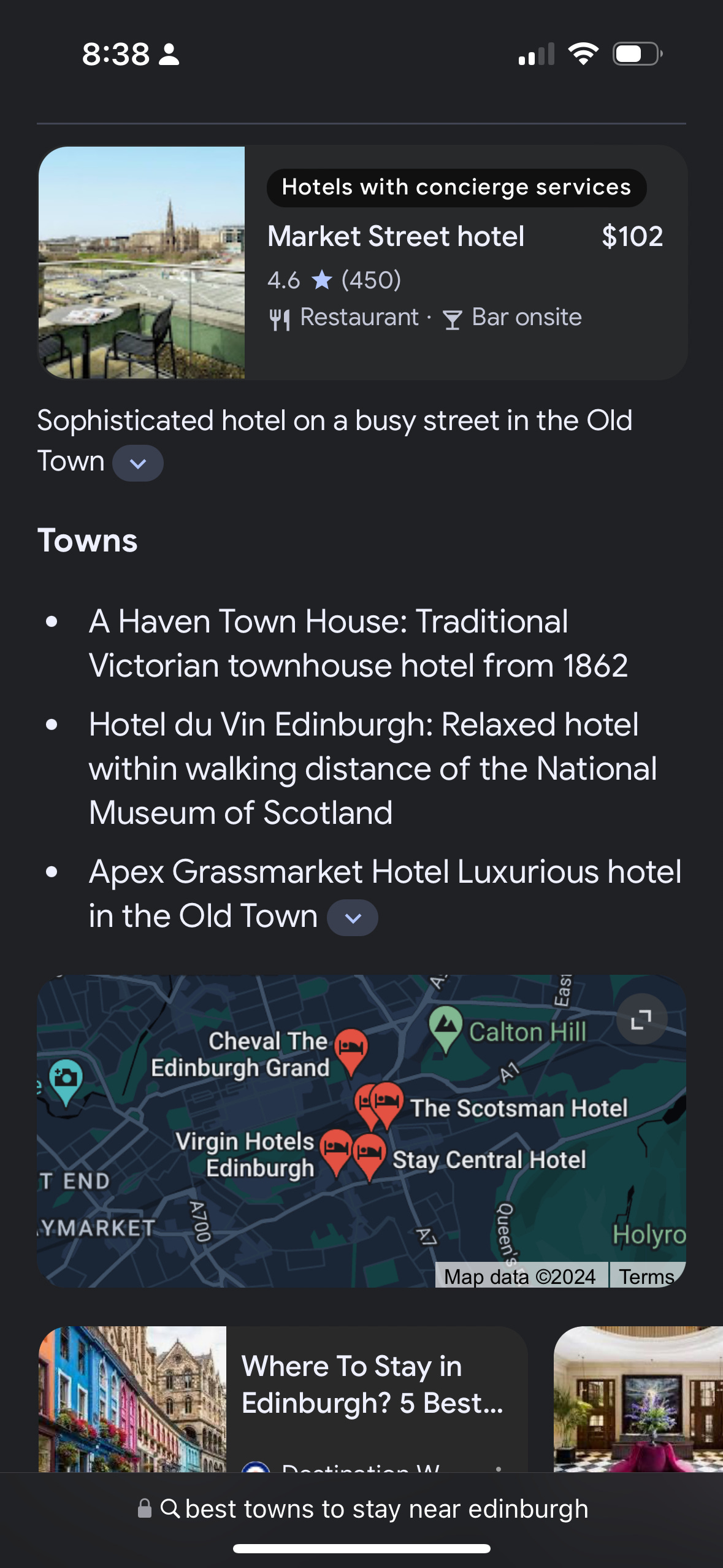

I tested an SGE query for a hotel in Edinburgh. The result was a long explanation of many hotels, tons of paid links, and some maps. It was an overwhelming amount of information, beyond what I would have gotten in the old 10 blue link world. It was a bad experience. Maybe that’s why SGE is rolling out so slowly. If a non-technically oriented user got the SGE results I just described, they’d wonder what the hell happened to their beloved Google, although I doubt the average Google user would leave for ChatGPT any time soon.

Despite the truth that Google has a massive, loyal user base that it needs to manage through the transition to an AI-first world, Google lacks the urgency and innovative flair that it faces from OpenAI. Where OpenAI seems to be achieving months of progress in weeks, Google seems to be achieving weeks of progress in months.

Google should be more aggressive in courting tech-first users who want the full power of AI rather than hedging with products to appease the entire user base. Google should also move fast and break some things, something OpenAI doesn’t seem afraid to do.

Google is the clear #2 in AI behind OpenAI, but they should be #1.

Setting Odds

Here’s the most reasonable view of Google’s situation with AI:

There’s a real chance Google loses the search war to OpenAI or some new competitor, but OpenAI bulls and Google skeptics ascribe too high a probability to that outcome.

Google has the most data information (20 years of search), it has resources to build the products, and it still has world class distribution (Android, Chrome, YouTube). The most likely scenario is that Google maintains its search lead through that superior distribution, user loyalty, and by building an AI-powered experience that’s at least as good as competitors.

Maybe Google loses a bit of share on the edges. Maybe it means the search golden goose loses a little luster by virtue of different monetization or a different cost structure. But it probably doesn’t mean that Google’s dead.

As a shareholder, at least in the medium term, these reasonable probabilities might not matter.

The perception is that Google is moving too slow, and perception is reality. There’s a long road to Google losing dominance in search, but there’s also a long road to proving that they won’t. There’s a danger that Google becomes the Microsoft of the late 2000s-early 2010s if it hasn’t already. Stagnant. Boring. Fat and happy. No hunger. At risk of missing the next big thing (mobile in the case of Microsoft).

Bookies should still set the odds of winning the search war in Google’s favor, but it’s harder and harder to be excited about taking those odds.

Disclaimer: My views here do not constitute investment advice. They are for educational purposes only. My firm, Deepwater Asset Management, may hold positions in securities I write about. See our full disclaimer.

What Search Can’t Do + AI Can (Intelligent Alpha Update)

While AI has the potential to redefine how we find information, the more exciting opportunity for AI is in creation.

Search can’t create anything. It can’t think. It can’t hallucinate like generative AI, and that’s not a compliment. AI hallucinations are the manifestation of creative potential. Search can give you some links to a bunch of junk some human hallucinated on a website, or maybe now some junk an AI hallucinated on a website, but search can’t make anything up for itself.

Creativity is the application of intelligence, and machines have growing capability for creativity and intelligence.

My favorite application of AI’s creativity is Intelligent Alpha where I use generative AI to create investment strategies. Intelligent Alpha’s outperformance vs markets since inception remains strong with 12/15 core strategies I track ahead of benchmarks. The average core strategy remains +400 bps vs respective benchmarks.

Two observations about the performance of strategies so far in 2024:

The small cap strategies have trailed the Russell 2000 benchmark for a funny reason: SMCI. SCMI, a company that builds AI servers, is up almost 200% YTD even after being down 20% on Friday. That stock is still in the Russell 2000 despite being over $40 billion in market cap, and it’s powered 75% of the Russell’s performance YTD. SCMI is not in my small cap strategies because it hasn't been a small cap for a while. Sometimes benchmarks get a unique advantage. Intelligent Alpha will still win over time.

The long/short strategy has been great with shorts YTD. The most recent short win was ROKU, which reported disappointing earnings this week. Intelligent Alpha also had BA, MBLY, and KHC as shorts in the quarter. January as a particularly strong month for the strategy. February, despite the strong shorts, has been a little weaker due to some of the strategy’s longs.

The great thing about experiments like using AI to challenge markets is that the experiment never ends. Markets always evolve and change. AI will evolve and change with markets. It will get smarter over time, and I believe it will end up the future of active portfolio management.

The future of investing is intelligent.

Thanks Doug for the write up, very insightful as always. The analysis on search is fascinating and would agree with you calling Google out in the category as of yet; nonetheless, if I were Google I would not be too comfortable as the pace of innovation is unprecedented which could disrupt search as we know it. Large investors, and possibly those with an activist mindset, should exercise pressure at the board to encourage faster innovation. Yes Google should go back to its founding roots and exercise their innovation muscle to reenergise the company.

I am a big fan of the effort you have taken leveraging GAI in the investment management industry and the comment around the Russell 2000 is another demonstration of how dated are index providers in the current market environment where AI will surely disrupt them. This I have very little doubt and those Start Portfolio Managers should also embrace this technology to become relevant in a future where they become a team in the same way that pilots are in the airline industry. In such scenario, will PMs command the same economics they enjoy today? Will investors in their strategies willing to pay what they pay for them today? Will there be the emergence of investment marketplaces where investors access the strategies they need and in the way they need them?

It is a fascinating time to be alive today, despite the social and economic challenges that we have brought to ourselves.

Thanks for sharing!

Doug, I have a "challenge question". How can we ascribe some valuation to Apple's Vision Pro and their upcoming AI announcements? Most in the media have abdicated. Bank of America has made an attempt and published their work.

I'm asking you because of your insightful posts on adoption curves, hype cycles, etc. As well, Nvidia, shows the benefit to investors of getting in at the earlier stages of adoption cycles.