Intelligent Alpha vs the Quants

The factors in AI's success as an investor

Happy Easter 🐰🐰🐰.

The Deload explores my curiosities and experiments across AI, finance, and philosophy. If you haven’t subscribed, join nearly 2,000 readers:

Disclaimer. The Deload is a collection of my personal thoughts and ideas. My views here do not constitute investment advice. Content on the site is for educational purposes. The site does not represent the views of Deepwater Asset Management. I may reference companies in which Deepwater has an investment. See Deepwater’s full disclosures here.

Additionally, any Intelligent Alpha strategies referred to in writings on The Deload represent strategies tracked as indexes or private test portfolios that are not investable in either case. References to these strategies is for educational purposes as I explore how AI acts as an investor.

Machine Intelligence to Intelligent Alpha

Quantitative finance was the original AI-powered investor. Billionaire quants like Jim Simons of Renaissance Technologies, David Shaw of D. E. Shaw, and Cliff Asness of AQR proved that machines could find alpha in markets. And they keep proving it.

When institutional investors hear about Intelligent Alpha using generative AI to build investment portfolios, the first question is often how it compares to traditional quants. My answer: Intelligent Alpha invests, quants trade.

Quantitative finance is built on the idea that patterns in historical data can inform better investment decisions. Those patterns may be elaborate and intricate like those assumedly used by Renaissance, or they may be factors from academic research that explain some excess return. Whatever the pattern targeted by a quantitative model, the model doesn’t endeavor to know anything about the underlying companies of the stocks it selects. It doesn’t know that AAPL sells smartphones and AAN rents furniture. It doesn’t care. It shouldn’t care. The quant model just knows that one has great margins, a huge market cap, and poor recent momentum, and the other doesn’t.

If you don’t know what a company even does, you can’t really invest in it. A quant can only trade stocks based on a belief that some prior statistical pattern about them will repeat.

Modern AI creates the opportunity to combine the power of quantitative finance with a qualitative understanding of stocks. Intelligent Alpha convinces me that the generative AI breakthrough enables a new mechanism for generating alpha because it continues to perform well vs markets. My focus strategies are up an average of 570 bps over benchmarks since inception.

Without getting into the philosophical mud of what it means for an AI to understand something, Intelligent Alpha “knows” about the companies it selects. Certainly in any objective sense vs traditional quant models. My AI committee can explain qualitatively why it likes certain stocks if I ask it, and the explanations are plausible.

Based on how I build investment philosophies for my AI committee, I believe that qualitative factors represent more of Intelligent Alpha’s stock picking method than quantitative factors; however, the machine-based relatedness of Intelligent Alpha to quant strategies begs the question of how factors influence the results from generative AI’s stock picking.

Factor 101

Factors are a driving force in quantitative finance. A factor is a certain characteristic of a set of stocks that may explain differences in relative returns.

Legends of finance academia Eugene Fama and Ken French gave power to factors when they famously introduced their three-factor model: market risk, size, and value. Market risk is beta. Lower beta stocks counterintuitively tend to outperform higher beta over the long run. Size is the relative size of companies. Smaller cap stocks tend to outperform larger cap stocks. Value is a catch-all for valuation measures of a stock. Stocks that trade at lower multiples of some metric — sales, earnings, FCF, etc. — tend to perform better than stocks that trade at higher multiples.

Quality is another popular factor later added by Fama and French. Quality factors in that stocks with greater profitability tend to perform better than stocks with lower profitability over time. The other big factor is momentum. Momentum is the effect that stocks that are going up tend to keep going up and vice versa.

While there are other factors, the big five — market risk, size, value, quality, and momentum — dominate most popular quant strategies. Those factors also do a great job explaining why human managers generate excess return.

AQR did a study called “Buffett’s Alpha” in 2013 breaking down the factors that influenced Warren Buffett’s success. It showed Buffett’s returns were largely explained by his optimization of three factors — quality, low beta, and value. That doesn’t take away from his record, but it creates a specific narrative to potentially explain his success, paraphrasing an interview from AQR founder Cliff Asness: Buffett basically trained himself to be a machine that laser focused on factors with minimal variation over a multi-decade period.

Buffett was sort of a quant before we had computers who could do it for him. Maybe that’s why more of his writing seems to be about human nature than advanced finance.

Factors may help explain Buffett’s style, but it was his qualitative understanding of businesses that drove his decision making. Buffett understood the businesses he invested in, the power of brands, the power of great products with no substitution, and the utility of persistent need for those products (Coke, Geico, Apple). It so happened that those kinds of companies are high on the quality factor and low on beta. Buying them cheap was the icing on the cake.

Like Buffett, Intelligent Alpha leverages a qualitative understanding of good businesses. Like Buffett, Intelligent Alpha favors some quantitative factors in its process. Like Buffett, Intelligent Alpha executes on its favorite qualitative and quantitative factors with machine-like consistency because…it’s literally a machine.

Factors that Drive Intelligent Alpha

Since starting Intelligent Alpha in July 2023, the major factors have performed with decent variance vs the overall market.

The momentum factor (MTUM, dark green line in the chart below) delivered the strongest outperformance at +29.9% vs +18.1% for the S&P 500. Quality (QUAL, teal line) and growth (IWF, orange line) also modestly outperformed the S&P. Value (IWD, pink line), size (IWM, purple line), and beta (USMV, red line) have all underperformed the S&P 500.

I haven’t had the time or resources to do a regression analysis on the dozens of Intelligent Alpha strategies to estimate specific factor impacts, but there are some logical impacts given how the strategies are built.

Most Intelligent Alpha strategies use my base investment philosophy which combines quality and value, not unlike Buffett. I’ve always thought the most sensible investment philosophy is to invest in great companies at decent prices. Pure value never made much logical sense to me as an active manager. “Let me buy a bunch of fundamentally cheap and largely crappy companies with the assumption they’ll mean revert.” They probably will mean revert, but then you're stuck owning a bunch of cheap crappy companies waiting for mean reversion. Hasn’t worked all that well the last several years.

Value paired with quality always made more sense to me. “Let me buy a bunch of really good companies optimizing for those that seem to trade at the most reasonable prices.” Who wouldn’t want to do that?

Beyond qualitative and quantitative elements of quality and value, I don’t instruct the AI investment committee to optimize for any other factors unless a strategy necessitates it (e.g. the Intelligent Momentum strategies with momentum or Minimum Volatility strategies with beta). Any other factor influence is an unintentional byproduct of the AI investment committee’s individual stock selections.

Take size as an example. Other than restricting size in selection sets depending on a strategy’s focus area, Intelligent Alpha doesn’t optimize for smaller companies on the historical suggestion that they outperform over time. Instead, Intelligent Alpha’s variance in size from benchmarks reflects where AI sees opportunity whether bigger or smaller.

Take the Intelligent Alpha large cap strategies. The Intelligent Select has about half the average weighted market cap of its SPY benchmark, but the Intelligent Equal Select is almost 3x its RSP benchmark. Both strategies are ahead of their respective benchmarks despite different optimizations on size.

The Intelligent Small Cap strategies are both smaller than the IWM, and both are ahead of the benchmark. The Intelligent Mid Cap strategies are both bigger than the IJH, the Conviction largest of the three and showing meaningful outperformance. The Mid Cap Select is slightly behind its benchmark but catching up.

We can probably attribute some of Intelligent Alpha’s performance to the natural factors favored in my philosophies, but we can’t attribute all of it merely to factors. Quality has worked. Value hasn’t. Size hasn’t mattered. AI as a stock picker seems to have made much of the difference.

The Religion of AI-Powered Investing

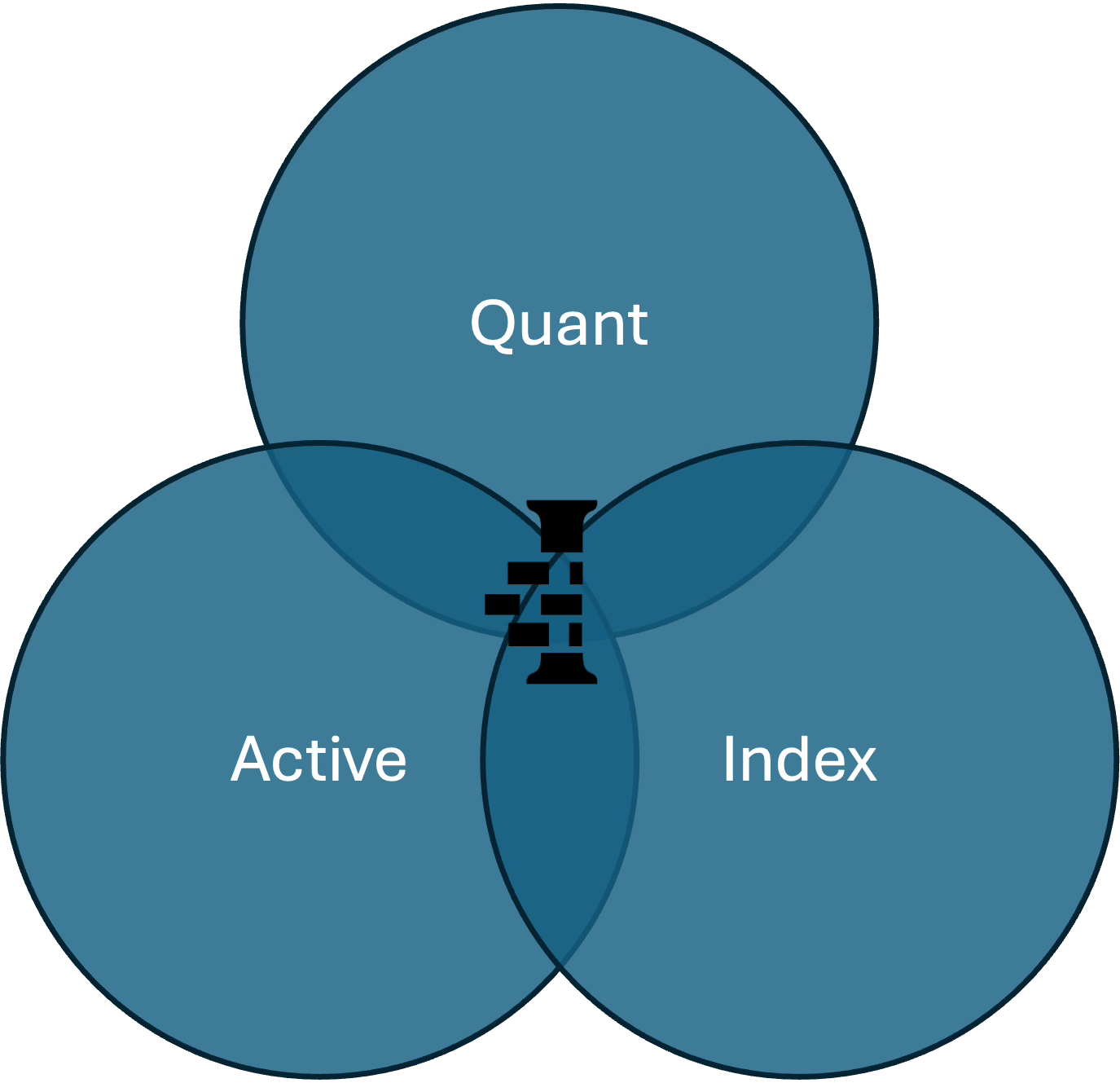

All of the Intelligent Alpha strategies, to some extent, represent an intersection of quant, active, and index style investing, and each of those investing styles is its own religion.

Indexing is a religion of patience and rationality. If you don’t think you can beat the market, take what the market gives you and let it compound.

Active is a religion of personality and intelligence. The greatest investors are cult-like figures with deep insights about business analysis and human nature. Customers who invest in active managers believe the manager’s superior intelligence will result in superior results.

Quant is a religion of data and averages. Quant strategies should work as statistically expected given enough time, you just have to be prepared to ride out some storms.

So what’s the religion of AI-powered investing? It’s a faith in continually improving machine intelligence that adds smarts to passive indexes, removes emotion from active management, and incorporates qualitative realities to quantitative approaches.

Intelligent Alpha is the best of all worlds. The future of investing is intelligent.

Excellent and balanced presentation of the advantages of intelligent investing! Grateful for your sharing your progressive and analytical views with the rest of us. Would like you to entertain the subject of how you would "guide" your committee to treat the concepts of cash/hedging in a potential down market. I know the quant and hedge fund guys had to struggle with this issue before getting a "handle" on their strategies. Anyway, great and succinct info.